New Public Disclosures Shed Light on Central Counterparties

Published: March 1, 2017

Reforms after the financial crisis promoted the use of central counterparties, or CCPs, which stand between the two parties to a derivatives contract. According to new data, CCPs hold enough resources to handle the failure of two members, and those resources are highly liquid and of high credit quality. Still, data gaps remain. (Viewpoint Paper no. 17-02)

Summary

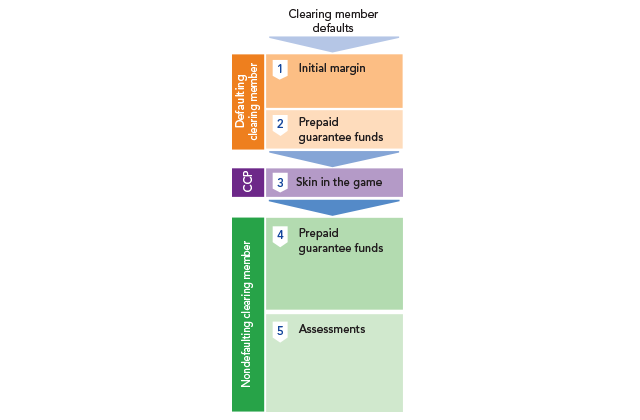

Reforms after the financial crisis of 2007-09 promote the use of central counterparties (CCPs) to improve transparency in derivatives markets. CCPs stand between the two parties to a derivatives contract. Unlike in bilateral trades, the two trading parties are not directly exposed to the other’s default. The increasing role of CCPs has focused attention on their potential risks and benefits. This OFR viewpoint examines data that CCPs began to report in 2016 to comply with international guidelines. Although the data shed light on the activities, financial condition, and risk management of CCPs, shortcomings in the data remain.