Countercyclical Capital Constraints Lower Consumption Volatility

Published: January 22, 2026

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the Office of Financial Research or the U.S. Department of the Treasury.

At the start of the pandemic, to ease strains in the Treasury market, the Federal Reserve announced a temporary change in how banks’ capital requirements are calculated. An additional effect of this policy change was that banks had a greater ability to provide credit to consumers. In the working paper, “The Macroeconomic Consequences of Capital Constraints,” OFR Researcher Robert Mann, with Daniele Caratelli, Jacob Lockwood, and Kevin Zhao, show that these relaxed capital requirements resulted in increased bank lending to consumers.

Since the 2007-09 financial crisis, regulators have relied on bank capital requirements to help maintain financial stability. Higher capital requirements strengthen the balance sheets of financial institutions, making them more resilient to adverse shocks. However, these regulatory requirements also limit how much credit banks can extend to households and businesses. The authors show that absent the policy change, consumers would have spent less due to banks’ decreased lending capacity, which would have ultimately slowed economic growth.

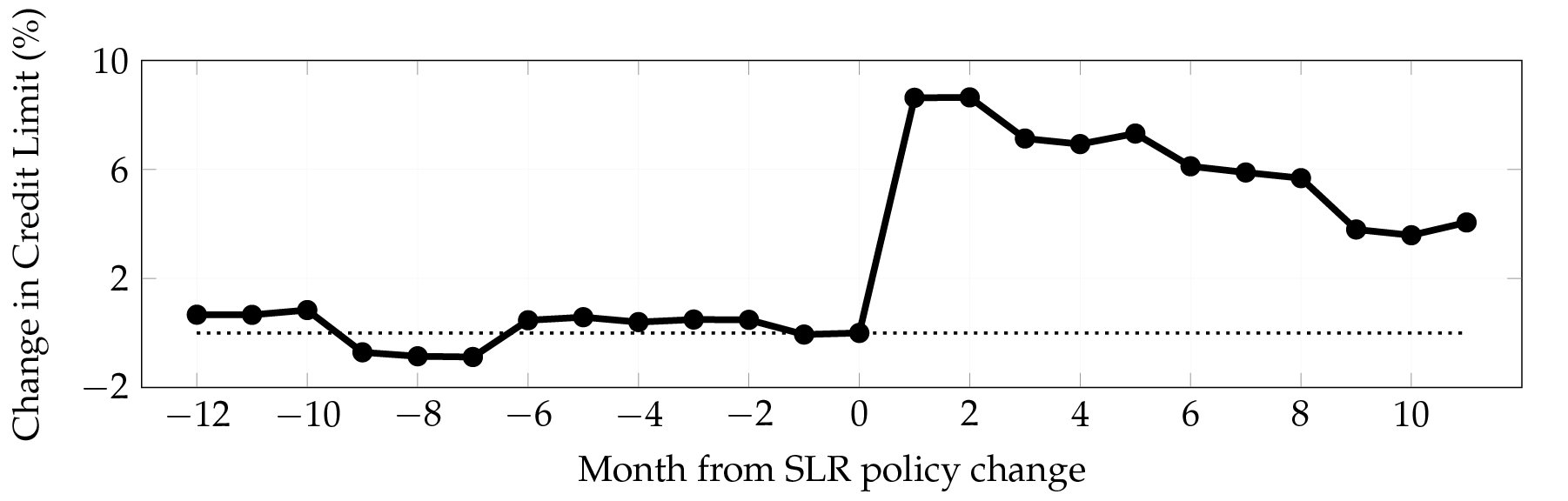

The banks whose capital requirements were loosened the most because of the policy change were able to lend more to consumers via credit cards (see Figure 1). Overall, if this rule change had not occurred, households would have had less access to credit and consumed less.

Figure 1. Credit Limit Response to Regulatory Slack

Note: Effect of policy on credit limit using slack and consumer by month fixed effects. All estimates are relative to Q2 2020.

Sources: FFIEC 101, Equifax Analytic Dataset, Authors’ analysis.

The authors find that without the regulatory change, household spending in the United States would have fallen by an extra 2.7% during the three years post the pandemic recession. This highlights that looser capital requirements during economic downturns can help smooth household consumption. Consumption volatility during the business cycle can be as much as 12% lower with a countercyclical capital buffer policy, mitigating the risks of sharp economic downturns and the associated disruptions to the financial system.