Sizing the U.S. Repo Market

Published: December 4, 2025

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policies of the OFR or Treasury.

According to new data collected by the OFR, the U.S. repurchase agreement (repo) market averaged about $12.6 trillion in daily exposures in Q3 2025, a number that is about $700 billion larger than previous estimates.1 The repo market is one of the world’s largest and most important short-term funding markets, providing funding for securities dealers and serving as a cash management tool for banks. Despite this fundamental role, this market has historically had limited transparency.

Following the 2008-09 financial crisis, regulators implemented measures to enhance market visibility by collecting both balance sheet and transaction-level repo data. To eliminate a data gap within the largest market segment, in December 2024, the Office of Financial Research (OFR) launched a collection initiative focused on transaction-level data for non-centrally cleared bilateral repo (NCCBR). With the data fully on board as of July 2025, researchers can now produce a transaction-based estimate of the U.S. repo market’s size for the first time, marking a significant advancement in financial market transparency.

Of the $12.6 trillion in daily average exposures in Q3 2025, $4.4 trillion was centrally cleared by the Fixed Income Clearing Corporation with another $3.1 trillion settled on Bank of New York Mellon’s (BNY’s) tri-party platform (excluding centrally cleared).2 NCCBR accounted for the remaining $5.0 trillion.3

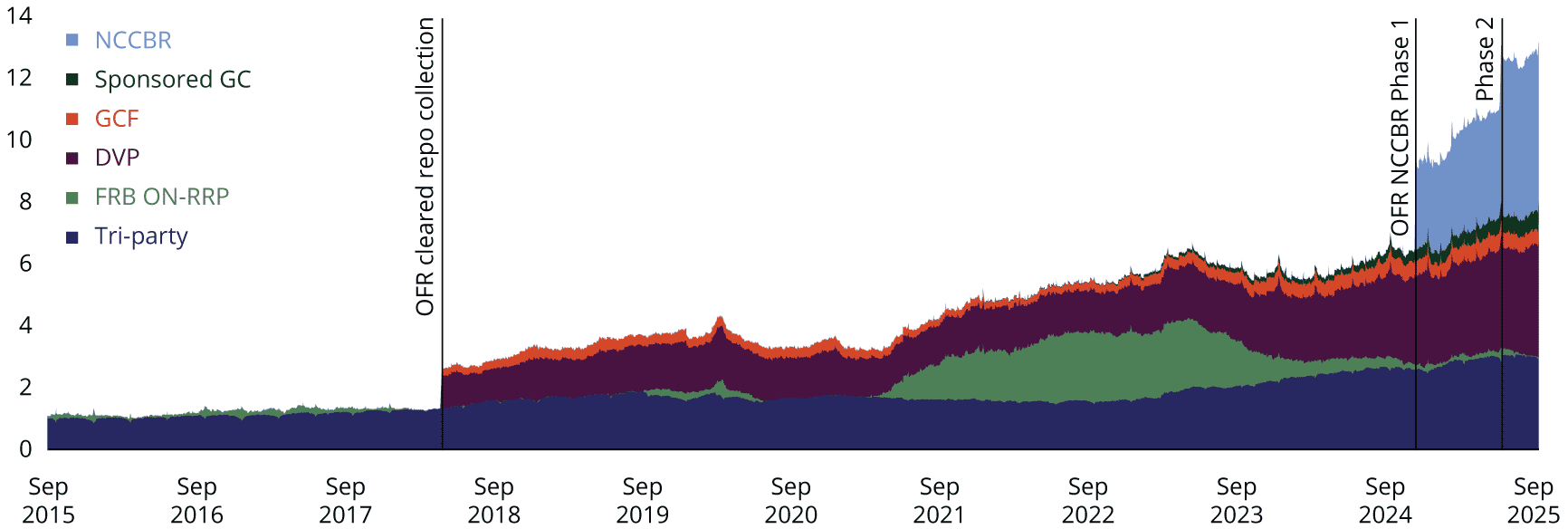

The OFR’s data on the U.S. repo market has increased over time as data gaps have been closed (see Figure 1). Data on tri-party repo settled by BNY are collected by the Federal Reserve Bank of New York and available from 2015. Data on cleared repo segments (from the OFR cleared repo collection) are available beginning in 2018.4 From 2021-24, use of the Federal Reserve’s overnight reverse repo facility (ON RRP) first increased and then declined.5 The OFR’s new NCCBR collection occurred in two phases. The first phase of the collection began in December 2024 and includes data collected from SEC registered broker-dealers. The second phase that began in July 2025 includes a broader set of financial institutions.

Figure 1. Outstanding Repo Exposures by Segment ($ trillions)

Note: Federal holidays and Good Friday religious observances removed. FRB ON-RRP: Federal Reserve Overnight Reverse Repo facility. NCCBR: non-centrally cleared bilateral repo.

Sources: BNY, Federal Reserve, OFR, Author’s analysis.

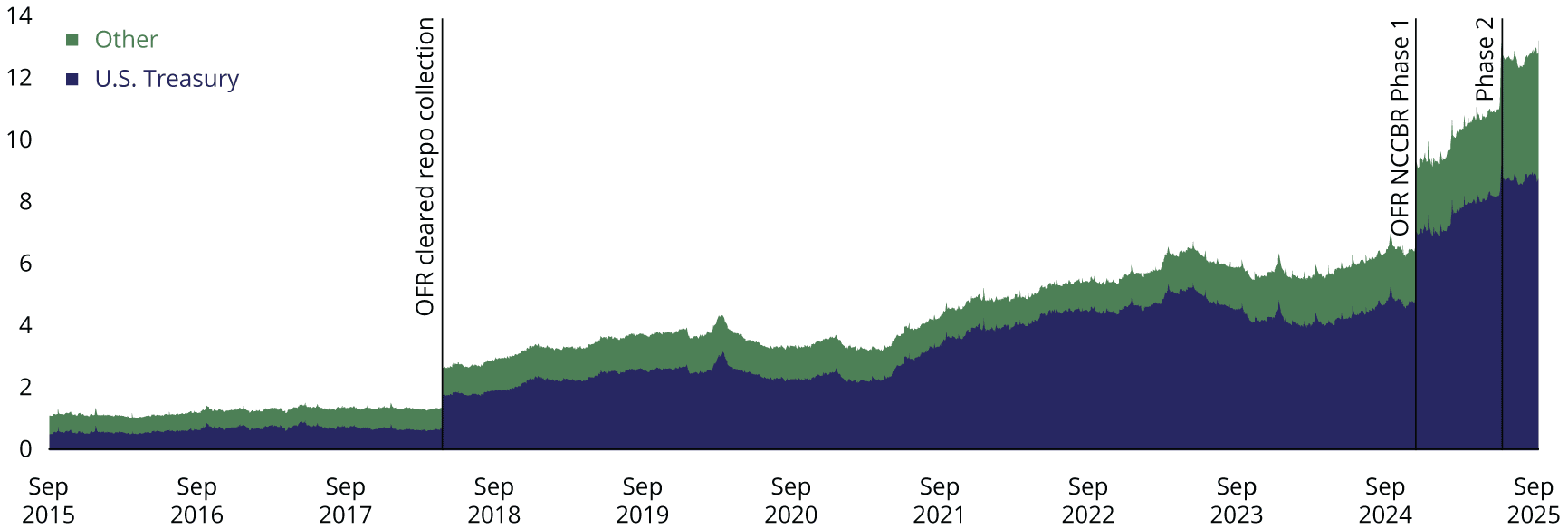

The OFR’s unique data offers rich detail on repos for each market segment, including information on counterparties, rates, tenor, and underlying collateral. In Q3 2025, 69.4% of repo exposures were collateralized by U.S. Treasuries (see Figure 2). The mix of collateral varies by segment. In Q3 2025, U.S. Treasuries collateralized 88.9% of exposures in the cleared repo segments, but only 61.8% of NCCBR exposures and just over half (52.6%) of the exposures in tri-party.6

Figure 2. Total Repo Exposures by Collateral ($ trillions)

Note: Federal holidays and Good Friday religious observances removed.

Sources: BNY, Federal Reserve, OFR, Author’s analysis.

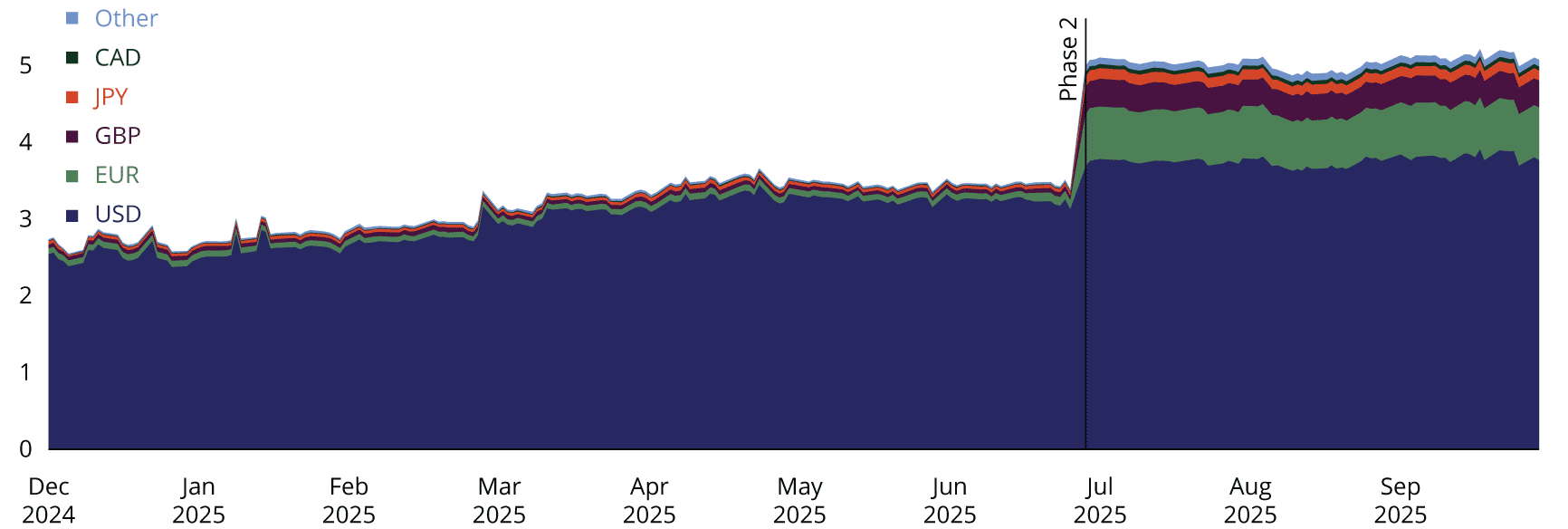

A particularly distinct aspect of the new OFR NCCBR collection is the inclusion of substantive quantities of non-U.S. dollar denominated repos, as well as repos between U.S. domiciled covered reporters and foreign counterparties. Nearly all repos that began to be collected from U.S. broker-dealers during the first phase of the collection are denominated in U.S. dollars. In contrast, most of the repo newly reported in the second phase are not. For these repos, typically both cash and underlying securities are denominated in the same foreign currency.

The most common currency after the U.S. dollar is the euro followed by the British pound, Japanese yen, and Canadian dollar (see Figure 3). Although most additional trades captured in the second phase of collection involve foreign currency, many counterparties to those trades are also active in U.S. dollar denominated repo trading and other U.S. dollar markets. The information on foreign exposures in the OFR NCCBR data therefore provides new visibility into foreign exchange risks and other cross-jurisdictional vulnerabilities.

Figure 3. Total NCCBR Exposures by Currency ($ trillions)

Note: Federal holidays and Good Friday religious observances removed. NCCBR: non-centrally cleared bilateral repo.

Sources: OFR, Author’s analysis.

Data from the OFR NCCBR collection are intended to be incorporated into the OFR’s Short-term Funding Monitor (STFM), which provides daily data on a wide range of U.S. repo market transactions.

-

Hempel, Kahn, and Shephard (2025) The $12 Trillion US Repo Market: Evidence from a Novel Panel of Intermediaries. Daily average repo exposures are calculated as the total cash value of all outstanding repo commitments. These numbers do not include forward commitments negotiated to start on a future date. ↩

-

For more information on U.S. repo market segments, see OFR Brief “Why Is So Much Repo Not Centrally Cleared?” available at https://www.financialresearch.gov/briefs/files/OFRBrief_23-01_Why-Is-So-Much-Repo-Not-Centrally-Cleared.pdf ↩

-

Including forward commitments, the size of the NCCBR segment is about $5.9 trillion. ↩

-

See https://www.financialresearch.gov/data/collections/cleared-repo-data/ for additional background on this collection. ↩

-

The Bank of New York Mellon’s Sponsored General Collateral Repo Service (Sponsored GC), which was launched in 2020, is also settled on their tri-party platform. ↩

-

Some NCCBR do not have associated collateral information. Information on tri-party collateral comes from the BNY settlement file. ↩