OFR's MMF Monitor Shows Shift to Cleared Repo Lending

Published: September 11, 2025

Views and opinions expressed are those of the author and do not necessarily represent official positions or policy of the Office of Financial Research (OFR) or U.S. Department of the Treasury.

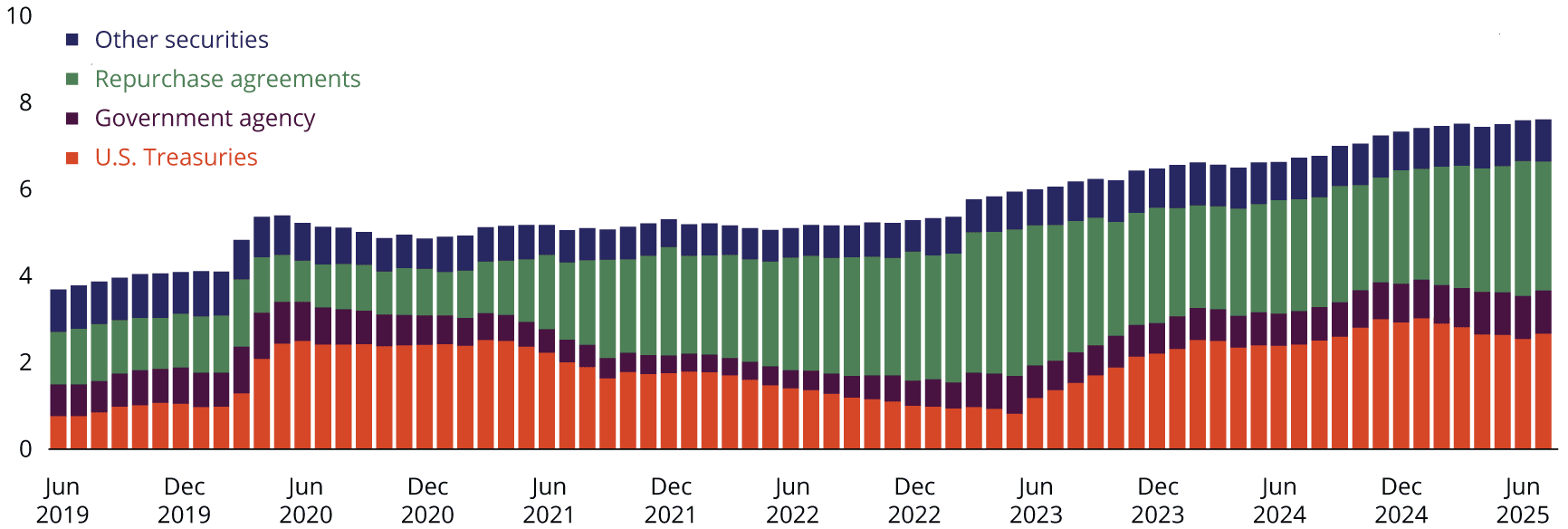

The assets of U.S. money market funds (MMFs) continued to rise, reaching a record high of $7.5 trillion at the end of Q2 2025, according to OFR’s U.S. Money Market Fund Monitor data (see Figure 1).

Figure 1. Trend in U.S. Money Market Fund Asset by Holding Type ($ trillions)

Note: Data as of July 16, 2025. Other securities include those issued by corporations, financial companies, municipalities, and other fund money market structures.

Sources: OFR Money Market Fund Monitor using the Securities and Exchange Commission Form N-MFP, Authors’ analysis.

The record amount of cash parked in MMFs reflects their competitive yields and perceived safety and liquidity. Investors’ ability to redeem MMF shares and access cash on the same or next business day is an advantage over other cash management options. Regulation limits the average maturity of MMF portfolios to ensure that funds can provide quick access to cash. As a result, the level of MMF assets can signal shifting investor sentiment regarding risk and the respective impact on available funding in short-term funding markets.

MMFs increased their overall repurchase agreement (repo) allocation to over $3 trillion (41% of assets). The increase in repo usage coincides with a decline of $267 billion in U.S. Treasury securities holdings. One reason for the decline was that net U.S. Treasury bill issuance itself declined by $372 billion, as the U.S. statutory debt ceiling was binding during the quarter.

MMFs have more investments in repo, driven by a combination of factors: higher rates on private repo relative to the Federal Reserve’s ON RRP offer rate, reduced supply of high-quality assets like U.S. Treasury bills, and increased cash that needed to be deployed into liquid investments. MMFs increased their private (non-RRP) repo outstanding by $243 billion to a record high of $2.7 trillion, making these investments nearly a fourth of the estimated $12 trillion U.S. repo market.1

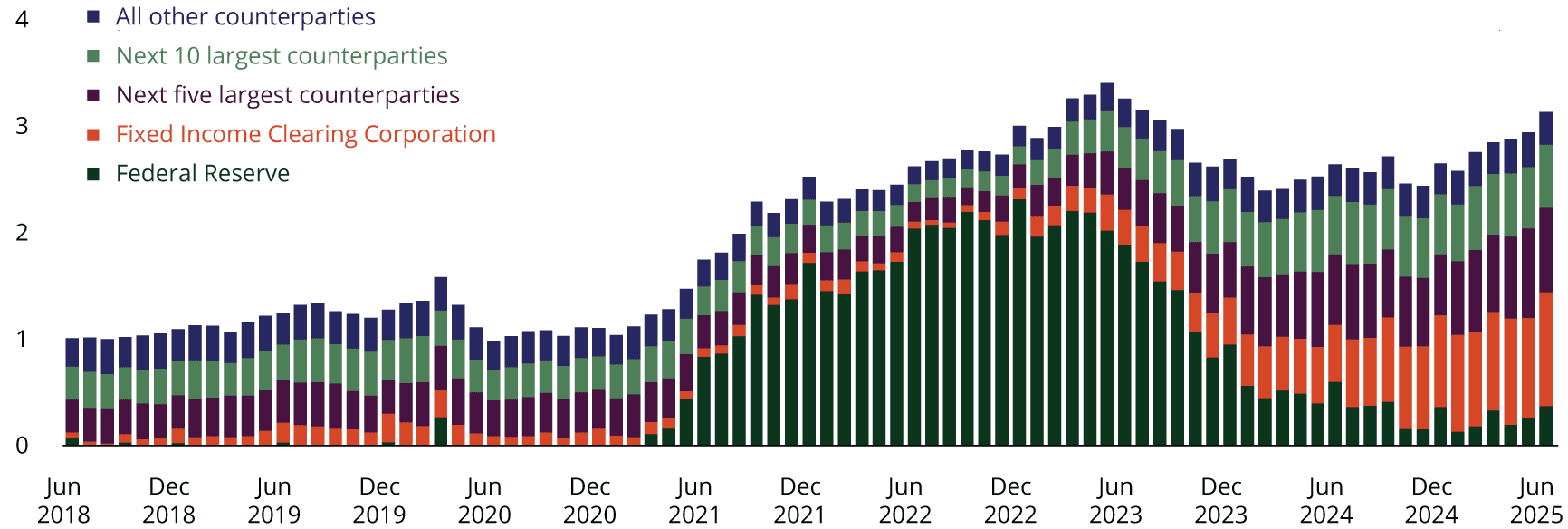

SEC Form N-MFP data also show that funds have a growing reliance on a handful of counterparties for their repo transactions. One of their largest exposures is to the Fixed Income Clearing Corporation (FICC) that many funds use to clear their repo (see light blue, Figure 2).

Figure 2. U.S. Money Market Fund Repo by Counterparty Groups ($ trillions)

Note: Data as of July 16, 2025.

Sources: OFR Money Market Fund Monitor using the Securities and Exchange Commission Form N-MFP, Author’s analysis.

MMFs, like most non-bank institutions, are not direct members of FICC. To access FICC’s clearing services for repo trades, they use the central clearinghouse’s sponsored repo program. In this arrangement, a clearinghouse member “sponsors” an MMF’s access to FICC’s clearing services by fulfilling certain requirements. FICC then becomes the legal counterparty to both the sponsoring member and the MMF.

While FICC becomes the counterparty, the MMF still has indirect exposure to the sponsoring dealer. The sponsor typically guarantees performance of its sponsored members and contributes margin and clearing fund requirements to FICC on their behalf. If the sponsor fails to perform, FICC may terminate the sponsoring arrangement. The MMF could then lose access to the clearing platform and would have to change its repo counterparty allocation.

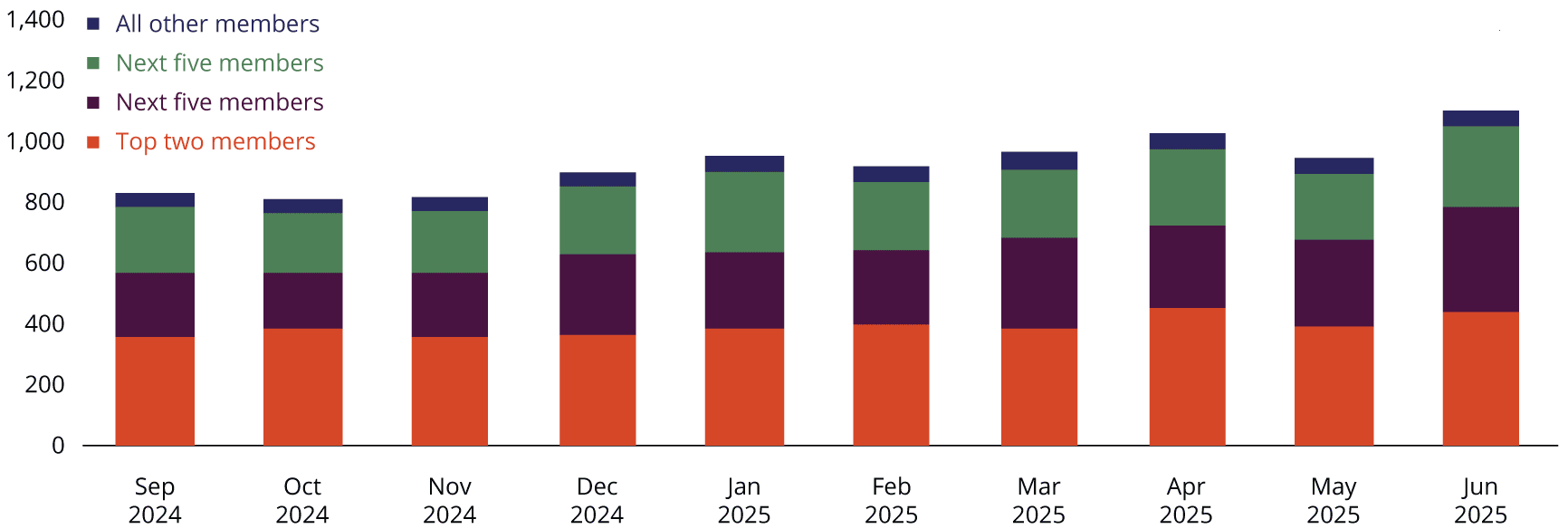

Only a handful of large clearing members are significant sponsors (see Figure 3). These clearing members also engage in non-cleared repo transactions with MMFs, which creates a multifaceted relationship between MMFs and large dealers.

Figure 3. MMF FICC Repo by Sponsoring Members ($ billions)

Note: Data as of July 16, 2025.

Sources: Securities and Exchange Commission Form N-MFP, Authors’ analysis.

-

Sam Hempel, R. Jay Kahn, Julia Shephard (2025). “The $12 Trillion US Repo Market: Evidence from a Novel Panel of Intermediaries,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 11, 2025, https://doi.org/10.17016/2380-7172.3843. ↩