OFR Hedge Fund Monitor Shows Repo Reversal

Published: June 2, 2025

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the Office of Financial Research or the U.S. Department of the Treasury.1

The OFR’s Hedge Fund Monitor (HFM) was updated in late April to reflect Q4 2024 Securities and Exchange Commission (SEC) Form PF data for Qualifying Hedge Funds.2 Hedge fund Q4 repurchase agreement (repo) borrowing declined 9% quarter-over-quarter to $2.5 trillion following eight consecutive quarters of growth.

Repo borrowing is a key source of leverage for hedge funds. In these secured borrowing transactions, hedge funds borrow cash by posting securities, such as U.S. Treasury and foreign sovereign debt, as collateral. If a hedge fund defaults on its repayment obligation, the lender can sell the collateral to repay its loan. By creating a secure and flexible market for temporarily monetizing government debt, repo markets improve the efficiency of financial markets more broadly.

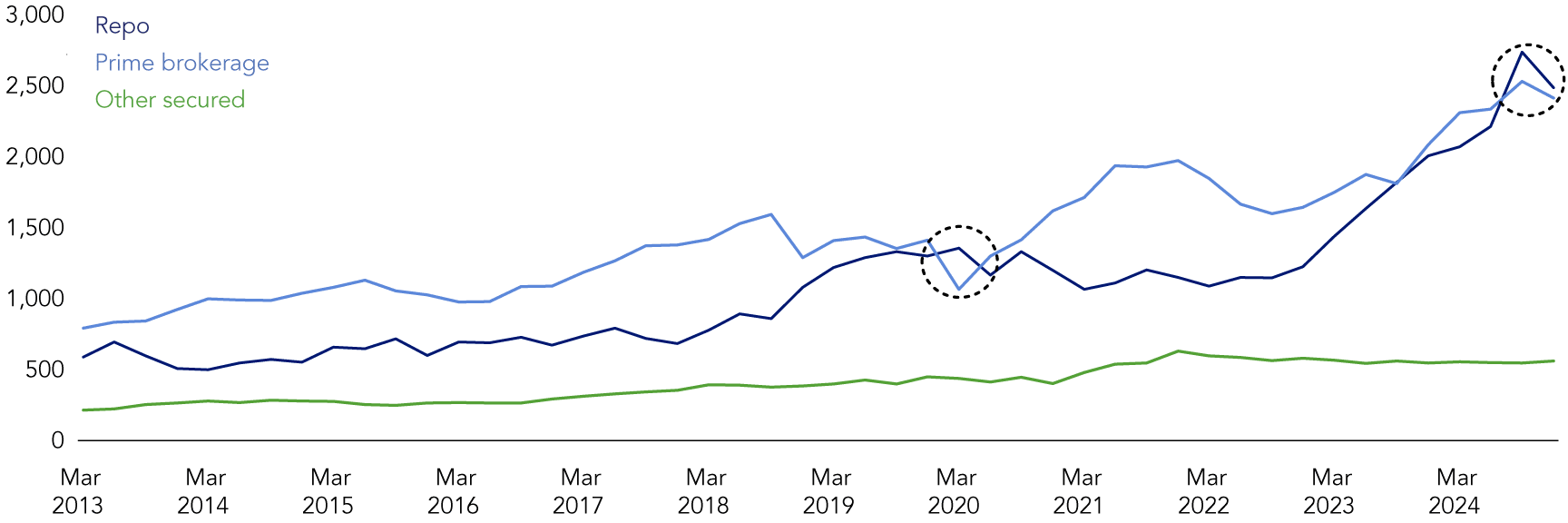

Notably, the Q4 decline followed a record high for hedge fund repo borrowing in Q3 and exceeded prime brokerage borrowing (see Figure 1). The last time repo borrowing exceeded prime brokerage borrowing by a wider margin was Q1 2020, a period of extreme market volatility. From Q4 2022 through Q4 2024, repo borrowing more than doubled (up 104%), which facilitated additional leverage for multi-strategy, macro, and relative value funds.

Hedge fund repo borrowing increased so significantly during the past two years because hedge fund investments in Treasury and foreign sovereign debt increased. This growth is primarily due to cash-futures basis, cash-swap basis, and yield curve trades, which all involve repo financing.3 Growth in these trades is a function of many underlying developments, including increased issuance in Treasury and foreign sovereign debt markets. As these markets have grown, so too have hedge fund positions.

Figure 1. Borrowing by Type ($ billions)

Note: Data as of Q4 2024, from the OFR Hedge Fund Monitor. Data reflect only QHFs and are based on Securities and Exchange Commission Form PF question 43.

Sources: Securities and Exchange Commission Form PF, Office of Financial Research, Authors’ analysis

Historically, repo borrowing has declined in Q4 in nine of the last 12 years. However, the recent decline is notable as it was broad-based with 19 of the top 20 largest repo borrowers reducing borrowing.

This decline may have occurred for two reasons. First, banks face month-end, quarter-end, and year-end financial reporting requirements. More specifically, banks may temporarily adjust their balance sheets and lending activities to enhance certain regulatory capital ratios that are measured at the end of periods. Second, hedge funds may have locked in annual gains toward the end of last year and temporarily lowered the risk in their portfolios through reduced repo borrowing.

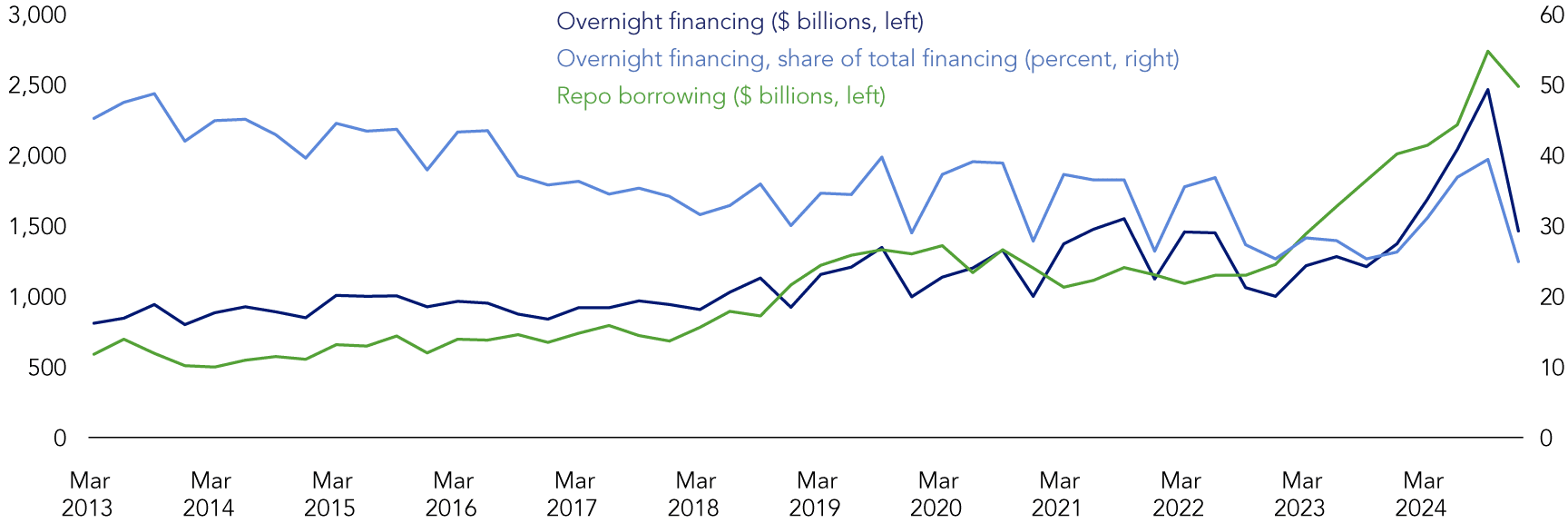

Repo transactions typically have a maturity that ranges from a single day, or “overnight,” which are generally rolled over daily, to multiple days, weeks, or months, known as “term.” From Q4 2022 through Q3 2024, growth in hedge fund overnight financing across all funding sources, including repo, coincided with the increase in repo borrowing (see Figure 2).4 Most of this increase resulted from a small number of large funds that are also the biggest repo borrowers.

Figure 2. Overnight Financing & Repo Borrowing

Note: Data as of Q4 2024, from the OFR Hedge Fund Monitor. Data reflect only QHFs and are based on Securities and Exchange Commission Form PF questions 43 and 46. Overnight includes uncommitted financing whereby the creditor is permitted to vary unilaterally the economic terms of the financing. Overnight includes all funding types (repo, prime brokerage, and other).

Sources: Securities and Exchange Commission Form PF, Office of Financial Research, Authors’ analysis

While borrowers may prefer overnight financing because of its typically lower rates, it also comes with greater risk than term financing. Overnight repo is subject to daily rollover risk and variability in financing rates from one day to the next. In contrast, term repo provides funding certainty over a specified period, reducing rollover risk and locking in a financing rate. In Q4 2024, funds increased their term funding as demonstrated by the decline in overnight financing (see Figure 2), reversing what had been a meaningful shift toward overnight financing during the first three quarters of the year.

Less reliance on overnight financing has positive implications for liquidity management. During times of stress, lenders may abruptly change credit terms (e.g., higher collateral haircuts) or reduce lending outright. Hedge funds facing liquidity challenges may be forced to deleverage by unwinding positions. Larger hedge funds generally mitigate this risk by maintaining relationships with many counterparties that can potentially substitute for one another and by incorporating term financing into their funding mix.

-

The authors would like to thank Robert Mann and Luke Olson for their comments and suggestions and Sara Stefan for data contributions. ↩

-

A Qualifying Hedge Fund (QHF) is any hedge fund with net assets of at least $500 million that is advised by a Large Hedge Fund Adviser. These funds submit SEC Form PF filings quarterly. Smaller hedge funds, which do not meet the QHF definition, submit annual filings. Only QHF data is included in the OFR HFM. See SEC Form PF, Office of Financial Research for more details. ↩

-

The Treasury cash-future basis trade is a relative value trade that involves financing the purchase of a Treasury security using repo while also shorting a Treasury future. Treasury cash-swap basis trade is another relative value trade that involves financing the purchase of a Treasury security using repo and entering an interest rate swap as the fixed-rate payer. Yield curve trades include “steepeners” and “flatteners” that aim to profit from yield differences across specific points on the yield curve. ↩

-

SEC Form PF includes information on available financing across different maturities for all borrowing sources. Repo overnight financing is not explicitly reported unless the only borrowing by the reporting hedge fund (question 43) is repo. ↩