OFR's MMF Monitor Shows Reduced Federal Reserve ON RRP Use

Published: May 22, 2025

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the Office of Financial Research or the U.S. Department of the Treasury.

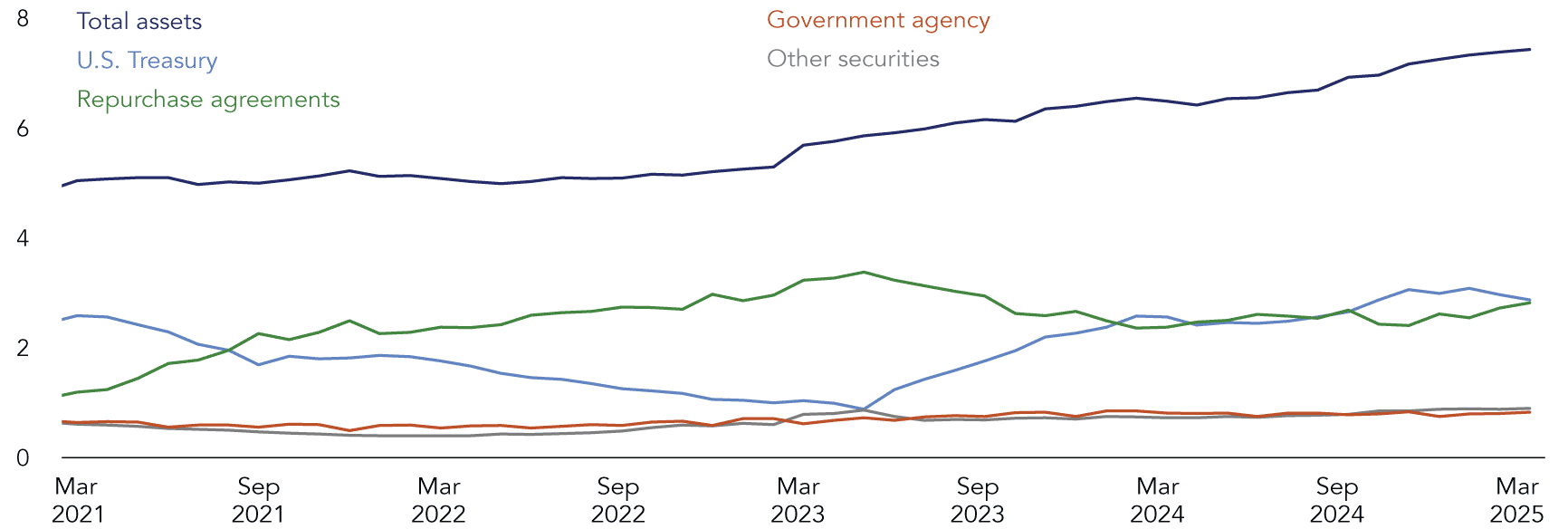

In Q1 2025, U.S. money market funds (MMFs) experienced strong cash inflows from retail and institutional investors that pushed assets to $7.4 trillion by quarter-end, according to OFR’s U.S. Money Market Fund Monitor data. Investors sought relative safety from broader market volatility and benefited from the yield advantage generally offered by MMFs over alternative investment products.

MMFs also lowered their exposure to U.S. Treasury securities and increased their repurchase agreement (repo) allocation to over $2.8 trillion (see Figure 1). The change primarily reflected high repo rates and a net decrease in U.S. Treasury issuance. The U.S. Department of the Treasury is conserving its borrowing authority until the federal debt limit is raised or suspended.1

Figure 1. Trend in Select U.S. Money Market Fund Assets Holdings ($ trillions)

Note: Data as of April 15, 2025. Other securities includes those issued by corporations, financial companies, municipalities, and other fund money market structures.

Sources: Securities and Exchange Commission Form N-MFP; OFR Money Market Fund Monitor, Authors’ analysis

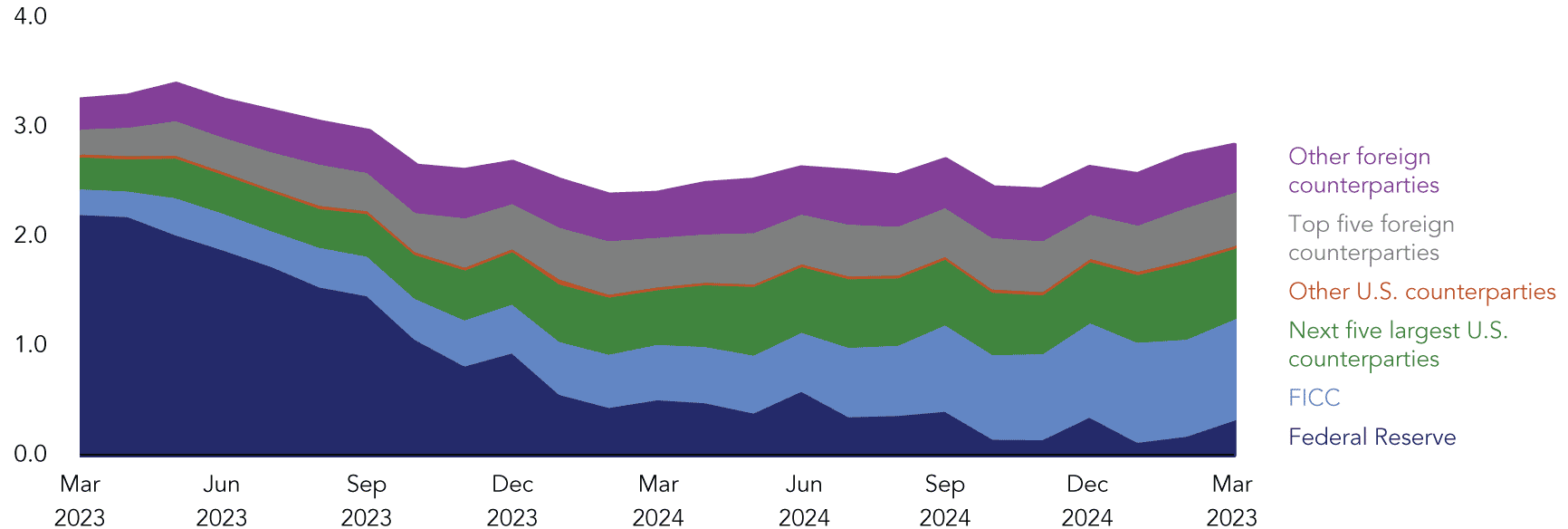

Attractive private market repo rates above the ON RRP offer rate contributed to the growth in MMF private repo transactions. MMFs increased their private repo holdings by $234 billion to a record high of $2.5 trillion at the end of Q1 2025. As a share of overall MMF assets, private repo has risen from 17% in early 2023 to 33% at the end of the most recent quarter.

The data shows that roughly a dozen counterparties accounted for most of the increase (see Figure 2). About a quarter of this growth was attributable to centrally cleared repos with the Fixed Income Clearing Corporation (FICC). With this growth, more than a third of MMFs’ repo exposure is to FICC.

Figure 2. U.S. Money Market Fund Repo Holdings by Select Counterparty Groups ($ trillions)

Note: Data as of April 15, 2025. Other securities includes those issued by corporations, financial companies, municipalities, and other fund money market structures.

Sources: Securities and Exchange Commission Form N-MFP, OFR Money Market Fund Monitor, Authors’ analysis.

Conversely, MMFs’ use of the Federal Reserve’s ON RRP facility stood at $349 billion at the March quarter-end, down 9% from year-end 2024, extending a gradual decline since early 2023. ON RRP usage may rebound in the future. Regulation requires that liquid investments that can be sold or mature within a week comprise a large share of MMF assets. Examples include Treasury and agency securities, ON RRP, and private repo backed by high-quality collateral. Rating agencies may impose counterparty exposure limits for the latter.2 If the investible amounts of the government securities and private repo decrease relative to MMF assets, MMFs may turn to ON RRP. Also, some MMFs use the ON RRP facility on quarter-end dates because certain securities dealers reduce money market financing to shrink their balance sheet on regulatory reporting dates.

Some MMFs use ON RRP as a tool to manage liquidity. The four largest MMFs account for over 60% of recent ON RRP balances. The largest ON RRP exposures as a percentage of fund portfolio assets were at large internal funds that manage liquidity for other funds across their fund family (see Figure 3). While funds can change their ON RRP balances at any time, the Federal Reserve limits single counterparties to a maximum ON RRP balance of $160 billion per day.

Figure 3. Select MMF ON RRP Usage

| Top 10 Users of ON RRP | Fund Category | Fund Complex Internal Fund | ON RRP Balances 3/31/2025 ($ billions) | Average ON RRP Balances Q1 2025 ($ billions) | Quarter-end Share of Total MMF ON RRP Usage (percent) | Q1 2025 MMF Share of Total ON RRP Usage (percent) | ON RRP Allocation as a Share of Fund Portfolio Assets (percent) |

|---|---|---|---|---|---|---|---|

| Fund 1 | Prime | Y | 47 | 35 | 14 | 15 | 84 |

| Fund 2 | Government | N | 39 | 38 | 11 | 16 | 11 |

| Fund 3 | Government | N | 31 | 10 | 9 | 4 | 7 |

| Fund 4 | Prime | Y | 24 | 17 | 7 | 7 | 86 |

| Fund 5 | Government | N | 24 | 8 | 7 | 3 | 10 |

| Fund 6 | Prime | N | 20 | 7 | 6 | 3 | 6 |

| Fund 7 | Government | N | 17 | 9 | 5 | 4 | 25 |

| Fund 8 | Government | N | 16 | 5 | 5 | 2 | 7 |

| Fund 9 | Government | N | 15 | 12 | 4 | 5 | 17 |

| Fund 10 | Government | N | 13 | 7 | 4 | 3 | 26 |

| Total | 349 | 233 | 71 | 63 | 18 |

Note: Data as of April 15, 2025.

Sources: Securities and Exchange Commission Form N-MFP, OFR Money Market Fund Monitor, Authors’ Analysis.

-

Secretary of the Treasury Scott Bessent to the Honorable Mike Johnson, letter, March 14, 2025, https://home.treasury.gov/system/files/136/Debt-Limit-Letter_20250314_Johnson.pdf. ↩

-

Many U.S. MMFs have obtained a money market fund rating from at least one of the nationally recognized statistical rating organizations. ↩