The State of Banks' Unrealized Securities Losses

Published: May 15, 2025

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the Office of Financial Research or the U.S. Department of the Treasury.

Rapidly rising interest rates during 2022 - 2023 contributed to larger unrealized losses in banks’ securities portfolios, which are mainly composed of fixed-income securities.1 Unrealized securities losses came under intense scrutiny when Silicon Valley Bank failed and triggered turmoil in the banking industry. Regional banks with large unrealized securities losses due to lack of appropriate interest rate hedging and a significant portion of uninsured deposits were vulnerable to runs. Larger banks did not exhibit the same level of vulnerability, although their banking subsidiaries generally had higher levels of unrealized securities losses. Unrealized securities losses could increase banks’ vulnerability if other developments, such as a large surge in commercial real estate loan losses, make depositors question a bank’s viability. The interest rate sensitivity of the value of the securities portfolio may be hedged by offsetting sensitivity of bank liabilities, but that hedge becomes ineffective if liabilities are withdrawn, so unrealized securities losses are a continuing vulnerability.

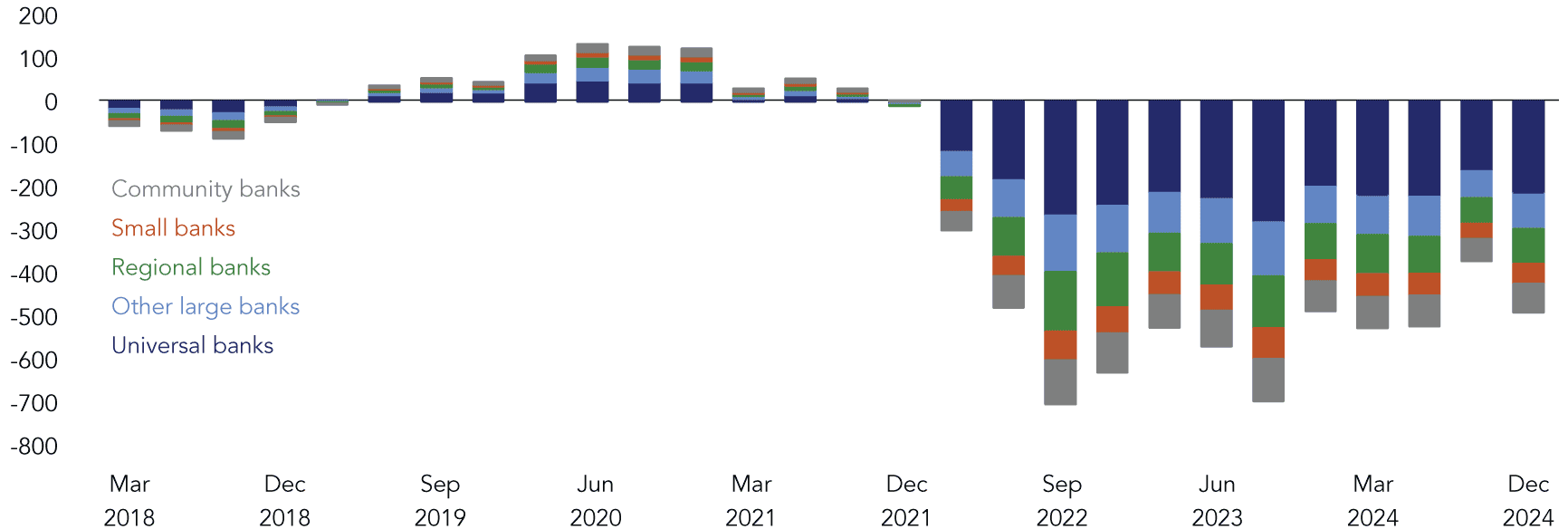

In 2024, the Federal Reserve reduced the federal funds rate target three times beginning in September. Aggregate unrealized securities losses moderated between June and September 2024 (Figure 1). However, since September, longer-term interest rates, in particular 30-year mortgage rates and the 10-year Treasury yield, have increased despite the lower federal funds rate. The higher Treasury yields have kept unrealized securities losses at elevated levels, albeit lower than their peak levels.

Figure 1. Unrealized Securities Gains by Bank Type ($ billions)

Note: Data as of December 31, 2024. Unrealized securities gains or losses reflect changes in both the held-to-maturity and available-for-sale portfolios.

Sources: Federal Financial Institutions Examination Council, S&P Capital IQ Pro, Authors’ analysis

Aggregate securities losses across all FDIC-insured depositories reached their highest levels in Q3 2022. As of December 31, 2024, bank depositories’ aggregated unrealized securities losses remained elevated at $481 billion, approximately an average of 8.6% of the fair value of their aggregate securities holdings and 19.9% of the aggregate equity held at the banking subsidiaries.

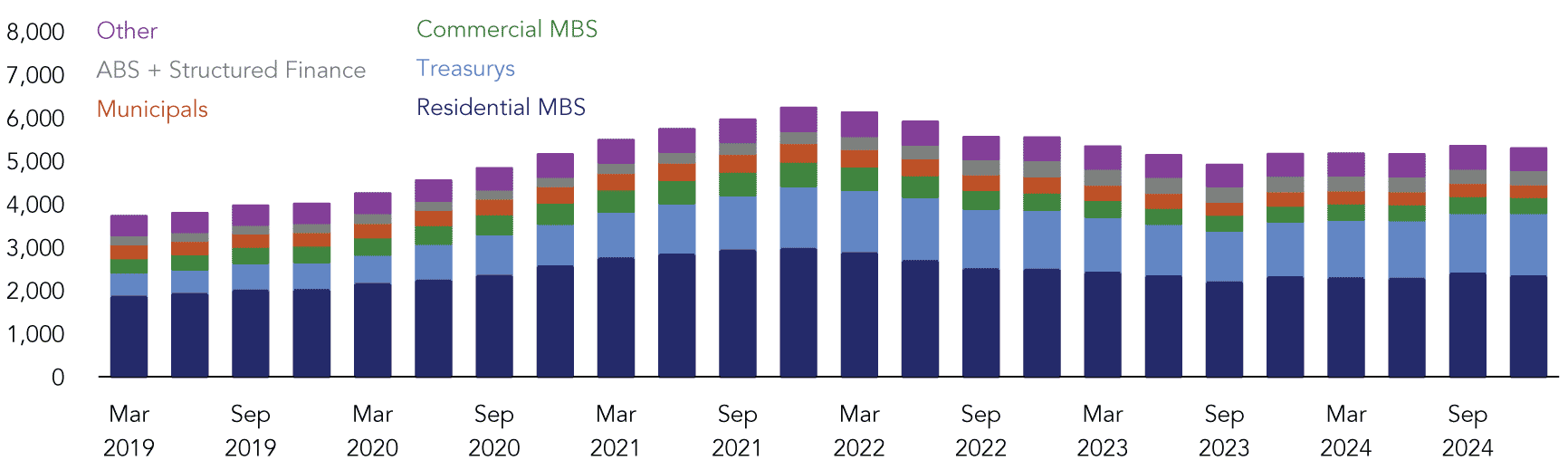

Figure 2. Securities Holdings at Fair Value ($ billions)

Note: Data as of December 31, 2024. Securities holdings reflect values in both the held-to-maturity and available-for-sale portfolios.

Sources: Federal Financial Institutions Examination Council, S&P Capital IQ Pro, Authors’ analysis

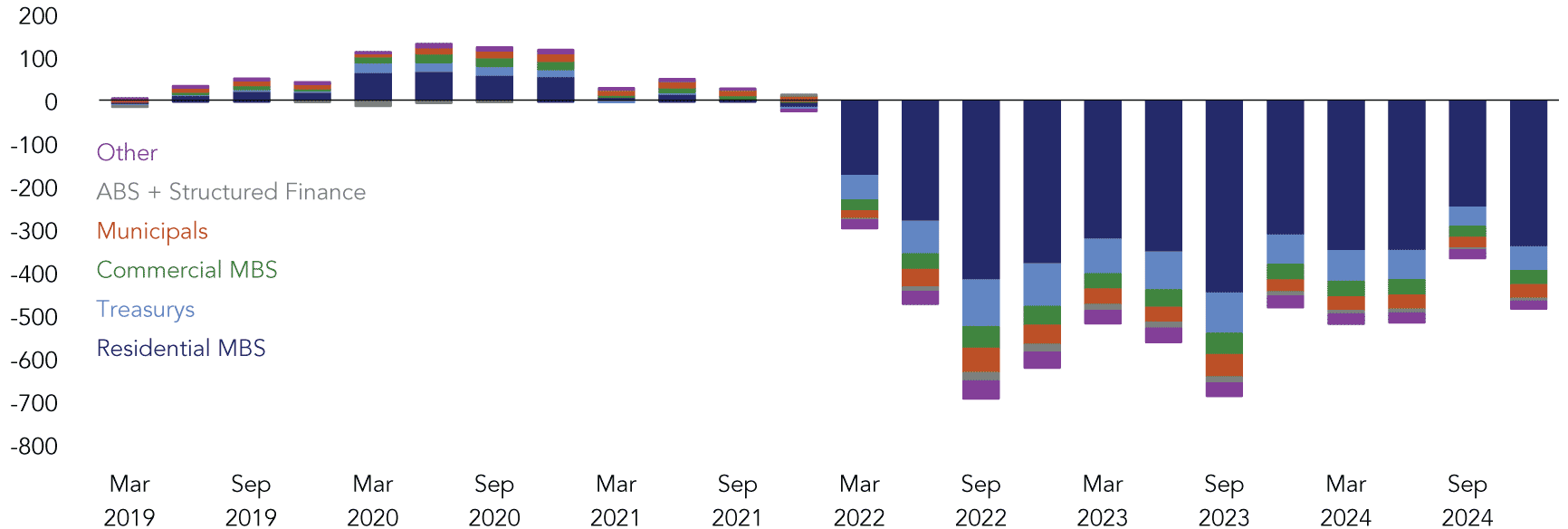

Figure 3. Gains (Losses) on Securities Holdings ($ billions)

Note: Data as of December 31, 2024. Securities gains (losses) reflect changes in both the held-to-maturity and available-for-sale portfolios.

Sources: Federal Financial Institutions Examination Council, S&P Capital IQ Pro, Authors’ analysis

Banks’ securities portfolios are composed primarily of residential mortgage-backed securities (RMBS) and Treasuries (Figure 2). Further evaluation shows RMBS as the primary contributor to overall aggregate securities losses. Treasury securities exhibited lower levels of losses relative to the size of their investments while commercial mortgage-backed securities (CMBS) and municipal securities showed higher losses despite making up a smaller share of investment portfolios (Figure 3).

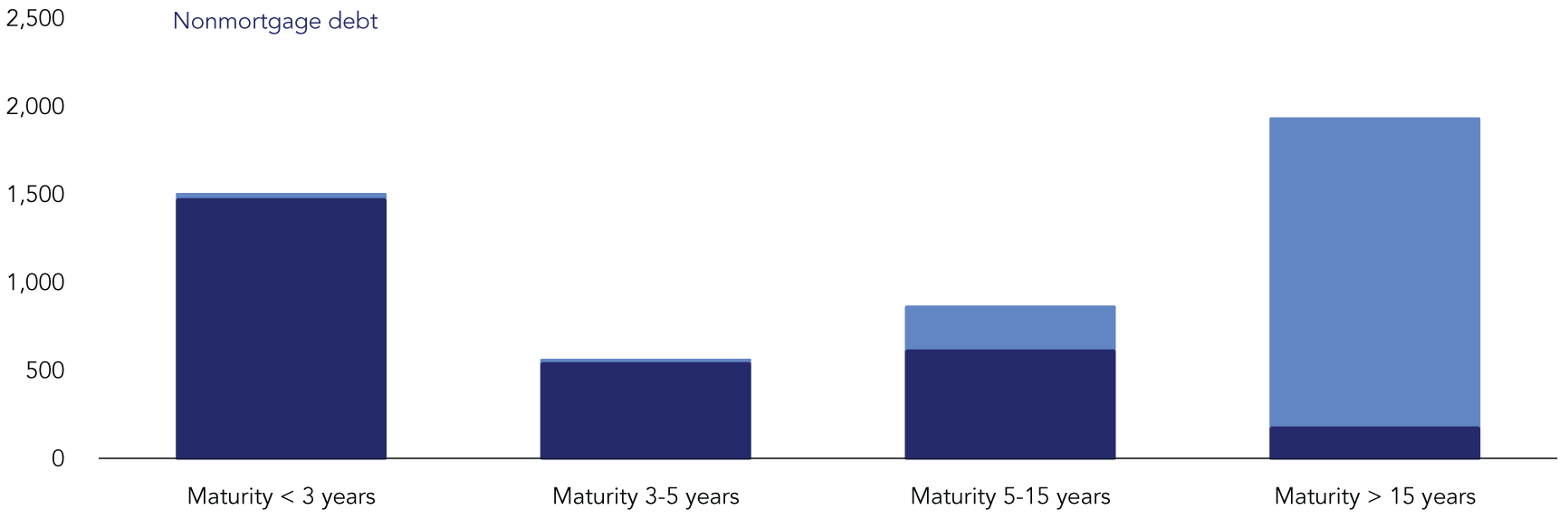

Most RMBS have maturities greater than 15 years coupled with negative convexity making their price less sensitive to decreasing rates (Figure 4). By contrast, nonmortgage debt generally has maturities of less than 15 years, with much of the debt maturing in less than three years. The longer average maturity of RMBS coupled with higher 10-year Treasury yields may account in part for why unrealized securities losses persist.

Figure 4. Banks’ Securities Maturity Distribution ($ billions)

Note: Data as of December 31, 2024.

Sources: Federal Financial Institutions Examination Council, S&P Capital IQ Pro, Authors’ analysis

Elevated yields impact the market value of banks’ securities portfolios. While unrealized securities losses alone may not have a direct impact on banks, they could amplify vulnerabilities when banks face stress and increase the chance of lack-of-confidence runs for some banks. While the Federal Reserve can influence short-term interest rates by adjusting the federal funds rate, long-term interest rates reflect financial market participants’ expectations of inflation and willingness to accept the risk of lending long term. The magnitude of future unrealized securities gains or losses will depend on the trajectory of long-term interest rates, related hedging, and the duration of banks’ securities portfolios. Market supply and demand can also affect the value of the securities, independent of the direction of interest rates.

-

This was published on December 27, 2023, OFR brief, Some U.S. Banks May Remain Vulnerable to Losses in Their Securities Portfolios. ↩