U.S. Money Market Funds Hit Record at End of Q1 2024

Published: May 23, 2024

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

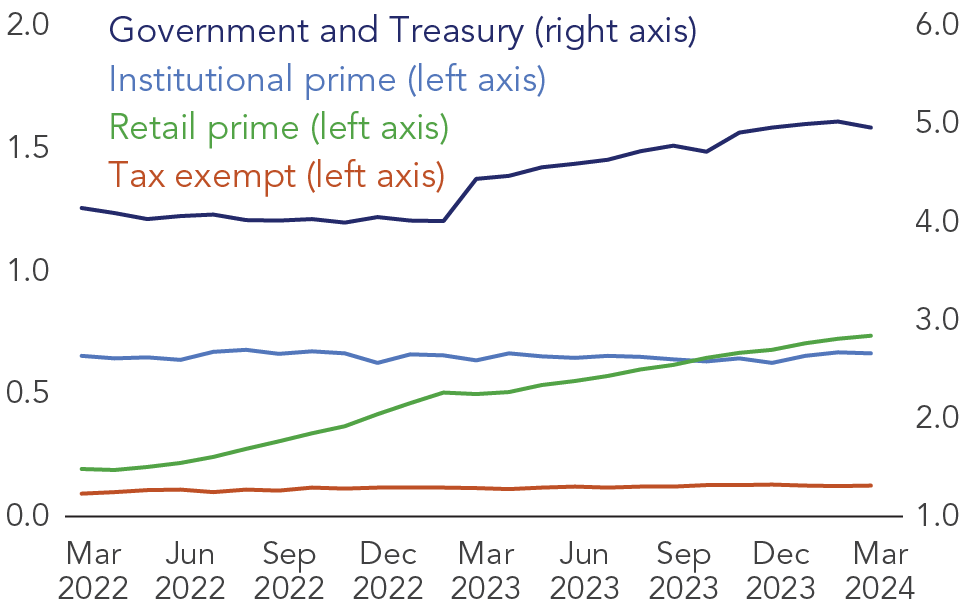

Interest rate movements and their expectations can generate opportunities with short-term funding vehicles, like U.S. money market funds (MMFs). Strong economic growth coupled with elevated inflation has created an environment where higher interest rates offer attractive opportunities for investors. As investors took advantage of this yield advantage, MMFs have seen an influx of cash, pushing their assets to a record $6.5 trillion on March 31, 2024, according to the OFR’s monthly U.S. Money Market Fund Monitor. MMFs hold mostly short-term investments, and, absent a market or liquidity event, should continue benefiting from the higher relative yields earned on holdings.

Retail Investors Continue to Account for Much of the Asset Growth

MMFs experienced cumulative inflows of $91.2 billion during Q1 of calendar year 2024, although flows were uneven. Retail funds accounted for most of the cumulative MMF net flows. Prime MMFs captured 59%, or $56.8 billion, of inflows within the retail fund category. In contrast, institutional investors on net redeemed $20 billion, or 0.5%, of net assets due to corporate tax payments and the direct purchase of newly issued Treasury bills.

Figure 1. U.S. Money Market Fund Assets by Fund Types ($ trillions)

Note: Data as of April 15, 2024.

Sources: SEC Form N-MFP, OFR Analysis, Author’s analysis

Overall, MMFs have remained an attractive investment vehicle in the near-term because of their comparatively higher yields and the Federal Reserve’s decision to maintain the federal funds rate within the target range of 5.25% to 5.50%. A shift in Federal Reserve policy or another market development could reverse the direction of MMF investor flows.

MMF inflows typically move in lockstep with interest rates. As interest rates rise, for example, MMF yields will increase faster than rates on bank deposits, and cash investors will then move funds into MMFs to take advantage of the rate differential. MMFs have had a record $1.4 trillion influx of cash since the Federal Reserve began raising interest rates in March 2022. As the Federal Reserve’s tightening cycle approaches an end and short-term interest rates decrease, cash investors will likely reverse course and shift investments out of MMFs, ultimately reducing MMF assets.

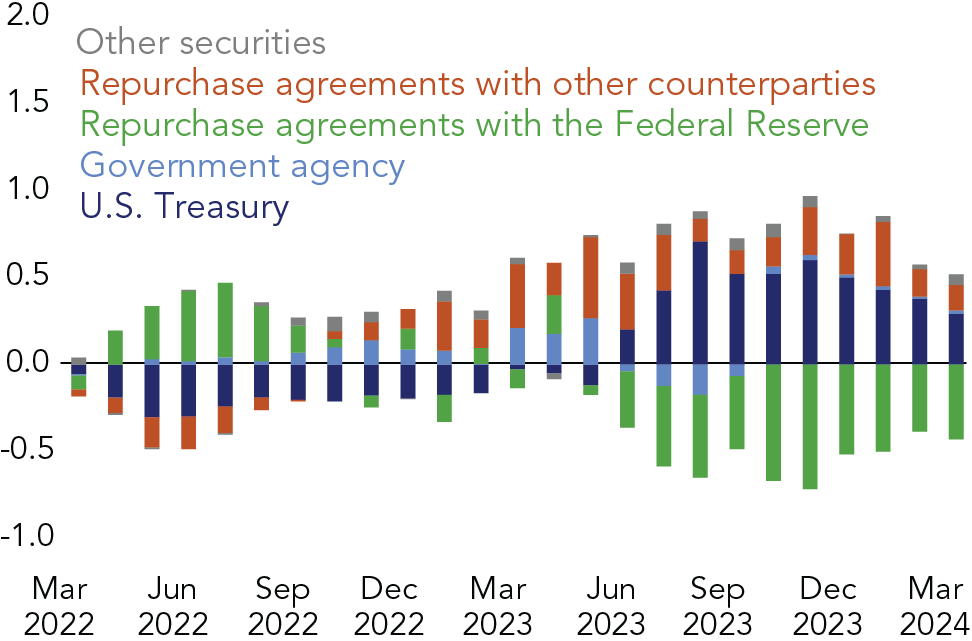

MMF Holdings of Private Market Repo and Treasuries Increased

During the first quarter, MMFs continued to increase their investment in U.S. Treasury securities and repurchase agreements (repo) with banks and dealers while reducing their utilization of the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP). This change largely reflected market participants’ expectations at the start of the first quarter that there would be future cuts in policy interest rates and an increased supply of U.S. Treasury bills that allowed funds to lock in prevailing high rates by extending out the yield curve. At the same time, there was also ongoing demand for repo financing from private counterparties willing to offer better interest rates relative to the ON RRP.

Figure 2. Rolling Quarter over Quarter Change in Select U.S. Money Market Fund Assets Holdings ($ trillions)

Note: Data as of April 15, 2024. Other securities includes those issued by corporations, financial companies, municipalities, and other fund money market structures.

Sources: SEC Form N-MFP, OFR Analysis, Author’s analysis

Two developments might stem from this portfolio reallocation. First, there could be an expected decline in Treasury bill issuance during the second quarter along with new MMF liquidity rules that are effective in April 2024 and require funds to maintain higher levels of daily and weekly liquidity. Second, suppose MMFs have more uncertainty about Federal Reserve policy and the path of short-term interest rates. In that case, MMFs are more likely to reduce the duration of their portfolios to minimize interest rate and liquidity risks. Investment alternatives with an overnight maturity, such as those available through the ON RRP, become more attractive in these circumstances.

Monitoring duration is essential to financial stability. A fund with fewer liquid assets may be less equipped to honor significant redemption requests in markets where liquidity is tight without engaging in a fire sale of securities. The SEC’s rules for MMFs limit the weighted average maturity of a fund’s assets to 60 days to reduce certain risks, including interest rate risk. The regulatory limit minimizes the consequences of mark-to-market losses if a fund is forced to sell securities to meet redemptions. In total, MMFs’ weighted average maturities, which can indicate liquidity and credit risk, fell below 38 days. This weighted average portfolio duration is well below the regulatory limit but above the level when the Federal Reserve began to raise policy rates.