OFR Identifies Factors That May Have Contributed to the 2019 Spike in Repo Rates

Published: April 25, 2023

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

A convergence of events caused a 2019 spike in repo rates, according to a new OFR Working Paper. On Sept. 17, 2019, intraday repo rates rose to more than 300 basis points above the upper end of the federal funds target range. This was 30 times larger than the same spread during the preceding week. In “Anatomy of the Repo Rate Spikes in September 2019,” the authors explain that the spike resulted in large part from a confluence of fundamental factors—large Treasury issuances, corporate tax deadlines, and an overall lower level of reserves—that, when taken individually, would not have been nearly as disruptive. In addition to these fundamental factors, the authors provide new evidence highlighting the role that limited transparency and market segmentation played in exacerbating the spike.

What Happened in Repo Markets?

Stresses in the U.S. repurchase (repo) markets, while uncommon, can occur unexpectedly. In mid-September 2019, repo rates spiked dramatically, rising to as high as 10% intraday. The disruption began on September 16—the day of Treasury settlement, which coincided with corporate tax deadlines. The combination of these two developments resulted in a large transfer of reserves from the financial market to the government, which created a mismatch in the demand for and the supply of repo that drove rates higher. However, even with this transfer in reserves, it is not immediately clear why repo rates rose as much as they did, especially since the peak of the stress occurred on September 17, after the Treasury settlement and corporate tax deadlines had already taken place.

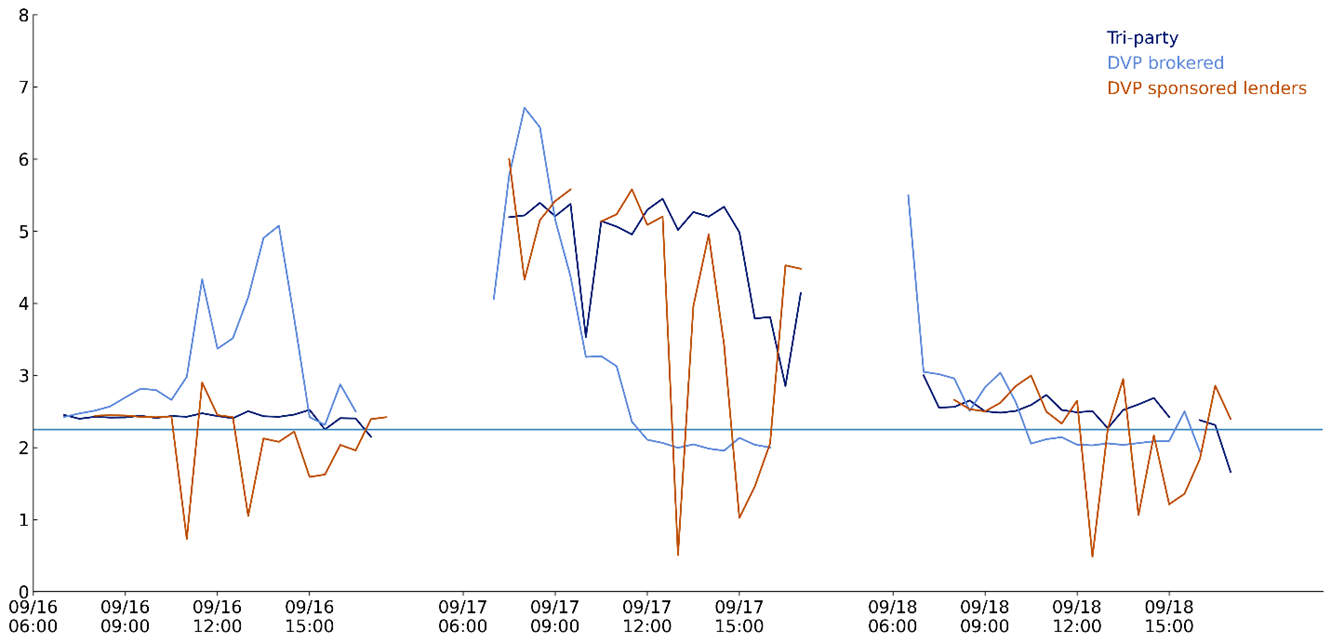

To aid in understanding the source of stress, Figure 1 below sheds light on the intraday pattern of rates among different segments of the market, using unique data from the OFR’s cleared repo collection.

Figure 1. Intraday Rates on Sept 16-18 in Tri-party and DVP

Note: Rates are volume-weighted averages.

Sources: OFR Cleared Repo Collection, Office of Financial Research

On September 16, rates did not increase until the afternoon and began increasing in the DVP-brokered market, most of which consists of trading between primary and nonprimary dealers. Volume was relatively low because 70%-80% of the day’s trades had already been negotiated by the time these spikes erupted, suggesting that only a limited number of firms were impacted by higher rates.

However, on September 17, the average rate in the tri-party segment (which is composed of banks and money market funds lending to dealers) rose to 6% and remained high for much of the traded volume that day. Following the Federal Reserve’s intervention at 9:30 a.m., rates declined substantially in the DVP-brokered market but remained elevated in other segments of the market throughout the day.

What Caused the Spike?

Rates in the repo market are highly dependent on the supply of Treasuries and reserves. By mid-September 2019, aggregate reserves had declined to a multiyear low of less than $1.4 trillion while net Treasury positions held by primary dealers had reached an all-time high. As a result, the reserve constraints on banks and bank-affiliated dealers may have played a contributing role in the repo spike.

As shown in the paper, the intraday pattern of lending by dealers on September 17 further reinforces the hypothesis that bank-dealers were indeed facing some reserve constraints. In addition, the subsequent liquidity provided by the Federal Reserve appears to have eased constraints on these dealers, who then provided an additional $10 billion into the repo market.

However, the dispersion of rates between markets highlights how segmentation in the repo markets, coupled with a lack of price transparency among segments of the market, may have contributed to the rate spike. Although a few market participants started to learn that cash supplies were scarce on September 16, others did not realize it or were unable to lend in response to increased tightness. These new factors likely contributed to the size of the rate spike especially on September 17.

What Can Policymakers Learn from Our Findings?

Understanding the sources of volatility in repo rates is important for policymakers, not only because repos represent a crucial source of funding and liquidity transformation in the U.S. financial system, but also because repo rates underpin the Secured Overnight Financing Rate (SOFR)—the determinant of interest rates paid by most households and businesses. By shedding light on how limited transparency and market segmentation can increase the fragility of the repo market during stress times, our work informs future policy considerations for strengthening repo market functioning.