Non-centrally Cleared Bilateral Repo

Published: August 24, 2022

For years, regulators have called for greater insight and transparency into the U.S. repurchase agreement (repo) market. As a crucial source of funding and liquidity for the U.S. financial system, repos provide short-term financing to banks, securities dealers, and other financial institutions to fund their liquidity provisions and leveraged investments. Currently, the daily volume of transactions on all U.S. repo markets exceeds $4 trillion.i

Within the U.S. repo market, the non-centrally cleared bilateral segment – where repo transactions are conducted between two firms without the involvement of a central counterparty or custodian – has been a blind spot for regulators. Unlike other repo segments where information and data are regularly published, the wholly bilateral nature of these transactions means there is no central source of data on this segment of the repo market.ii

What is known about the non-centrally cleared bilateral market?

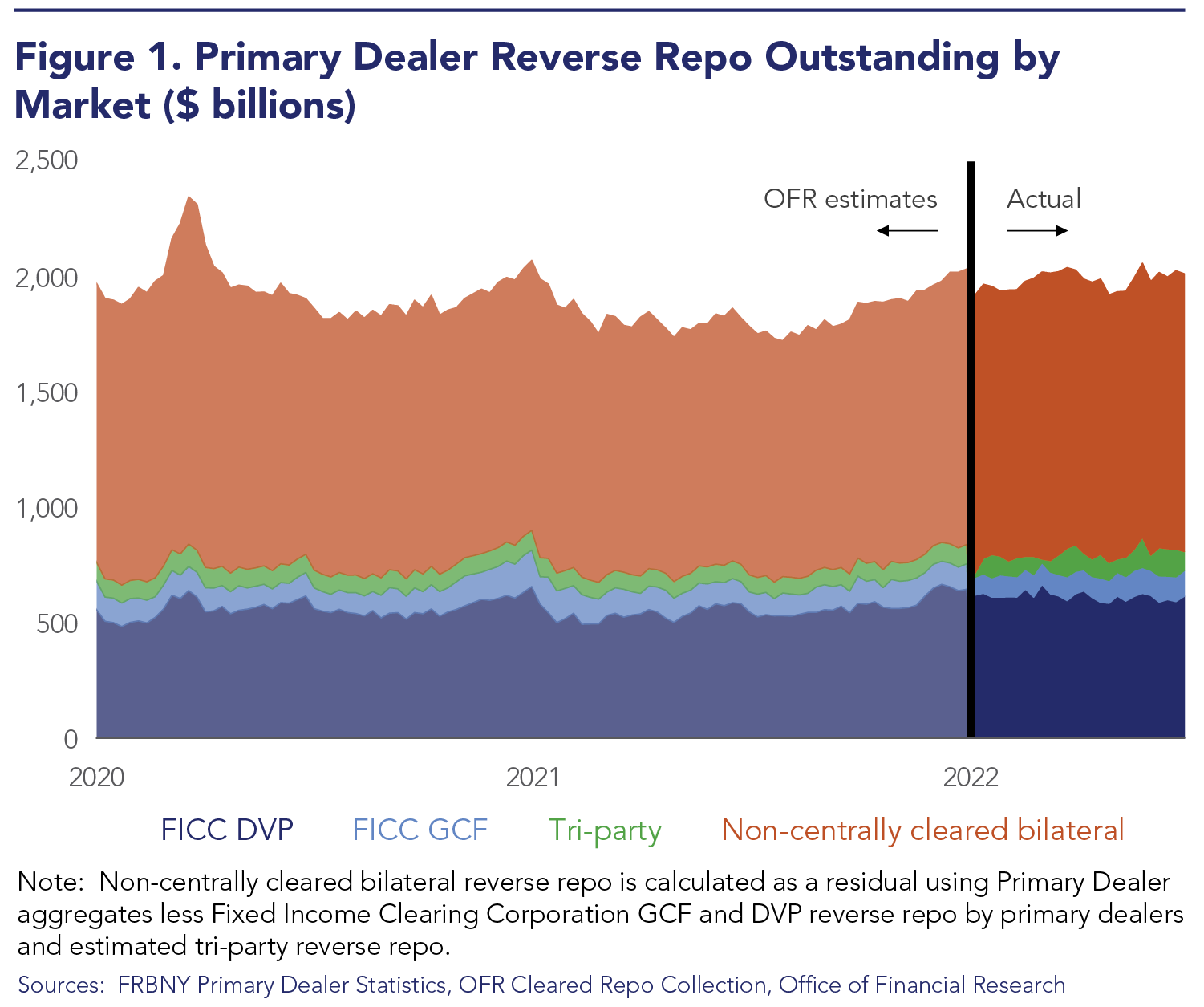

Until recently, little was known about non-centrally cleared bilateral repos. In January of 2022, the Federal Reserve Bank of New York updated their primary dealer statistics to capture the segments of the repo market used by primary dealers. Figure 1 shows the total split of primary dealer reverse repo between different repo venues, where we estimated primary dealer non-centrally cleared bilateral reverse repo prior to 2022 by calculating it as a residual, thereby extending the sample before the change in the primary dealer statistics.iii On average during the first three quarters of 2022, the non-centrally cleared bilateral market made up $1.19 trillion of primary dealer reverse repo (60% of the total) and $0.94 trillion of primary dealer repo (37% of the total).iv At more than $2 trillion in total exposure, this would make non-centrally cleared bilateral repo the largest segment of the repo market in gross exposure by primary dealers. Moreover, our estimated series prior to 2022 shows that primary dealer volumes in non-centrally cleared bilateral reverse repo have been stable during the previous three years, averaging $1.10 trillion (60% of the total) in 2021 and $1.20 trillion (62% of the total) in 2020.

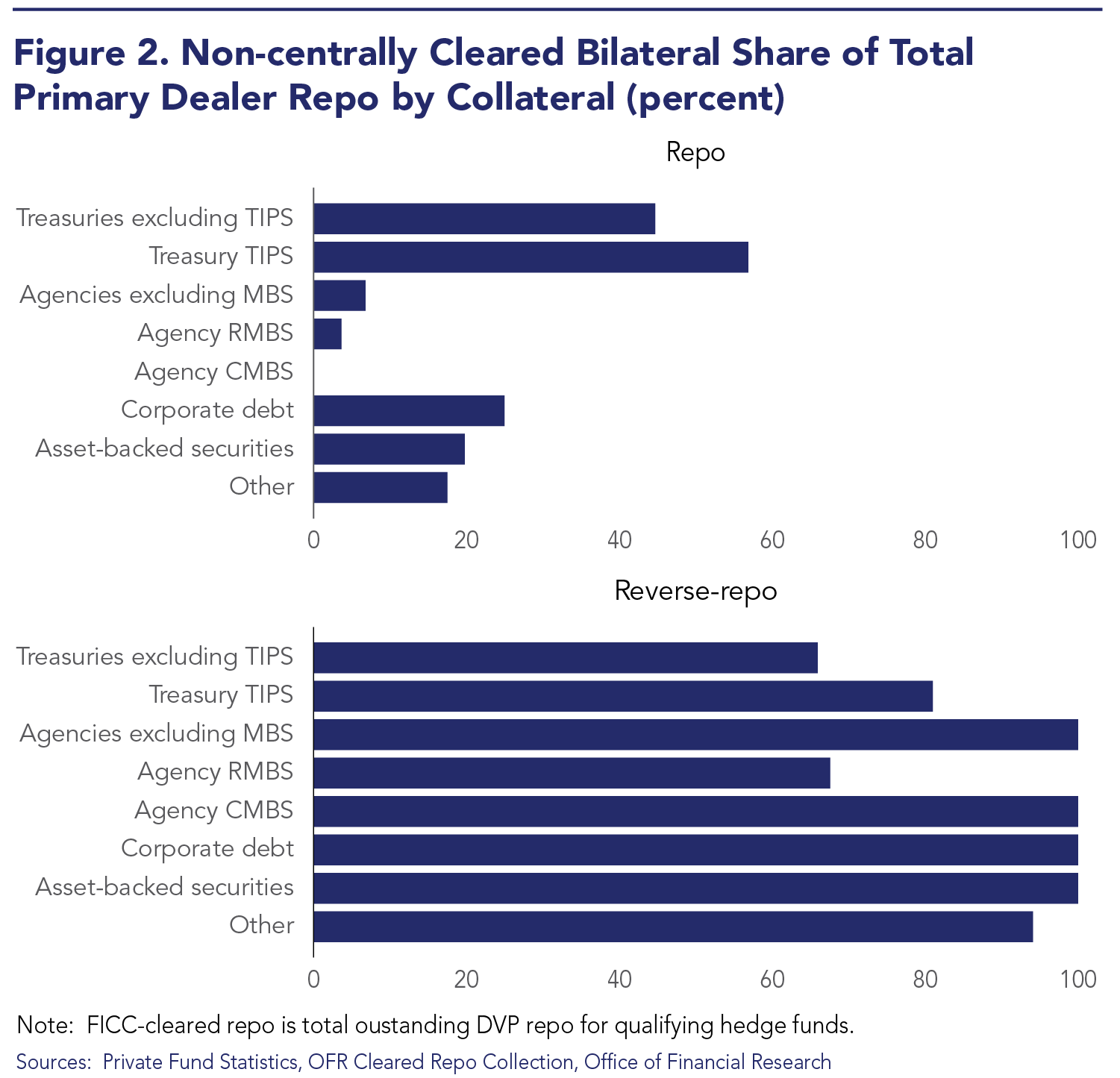

Non-centrally cleared bilateral repo likely contains a greater share of riskier collateral than other segments of the repo market. One feature of the market that attracts primary dealers is the ability to lend against non-Fedwire eligible specific collateral (centrally cleared specific collateral markets are limited to Treasuries and non-mortgage-backed agency securities). In Figure 2, our estimates show that non-centrally cleared bilateral is the primary venue for the use of asset-backed securities (ABS), agency excluding MBS, and agency commercial mortgage-backed securities (CMBS) collateral in reverse repo for primary dealers.

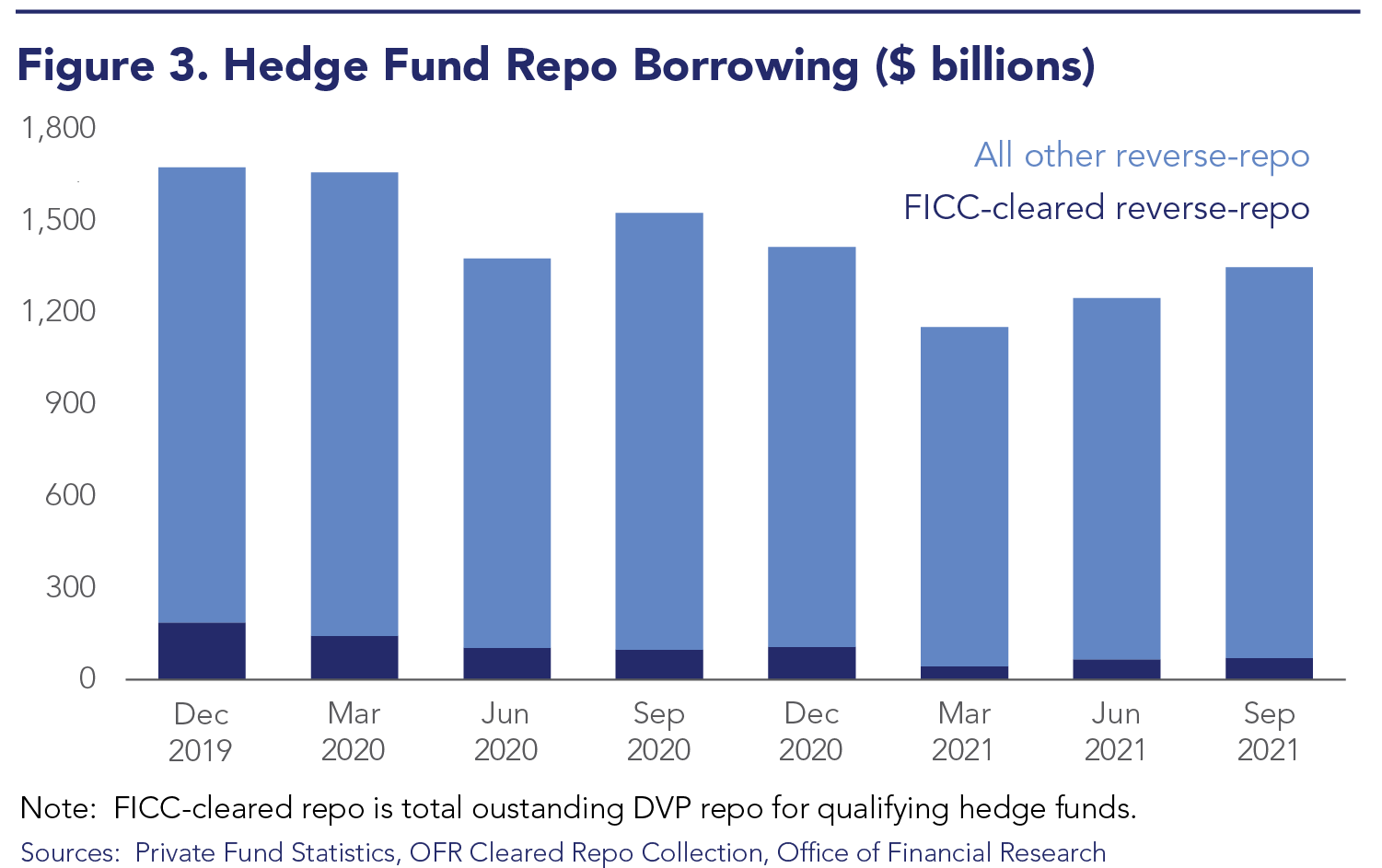

Finally, the non-centrally cleared bilateral market plays an important role in trading by non-bank financial institutions. For instance, non-centrally cleared is likely a key source of leverage for hedge funds. Figure 3 shows total repo borrowing by qualifying hedge funds as reported in the Securities and Exchange Commission (SEC) Private Fund Statistics, along with borrowing by hedge funds through cleared repo. On average throughout this period, the Fixed Income Clearing Corporation’s (FICC) DVP service only accounted for 8% of hedge fund repo borrowing, and the remainder is likely primarily through non-centrally cleared repo borrowing.

Benefits of a data collection

Since there is no central source data on the non-centrally cleared bilateral market, OFR is laying the groundwork to fill this critical gap through a data collection. Collecting more data on this market is critical for three reasons:

- Non-centrally cleared bilateral trades constitute a major segment of the U.S. repo market, as we have shown in this blog. More timely and comprehensive data can help regulators identify emerging risks in this market and make well-informed policy decisions.

- This data collection will allow policymakers to better capture the exposure of hedge funds and other non-bank financial actors to short-term funding markets. The March 2020 episode of Treasury market disruption highlighted how the reliance of hedge funds – particularly those that are highly leveraged – on short-term funding markets could create risks to financial stability. As a result, the Financial Stability Oversight Council (FSOC) recommended that OFR collect data on this market.

- By shedding light more broadly on the specifics of repo funding, market participants can better manage counterparty risks and benefit from enhanced price discovery.

To prepare for the data collection, the OFR conducted a series of meetings with various industry participants, including government securities dealers as well as data service providers who provide electronic trading platforms tailored to the unique needs of bilateral repo trades. By gaining the perspectives of these actors, OFR is able to better understand the economics and technical details of the market structure, trading and transaction flow, and existing data standards for bilateral repos.

Why is non-centrally cleared bilateral repo so popular?

One insight that emerged from our outreach was the driving forces behind volumes in non-centrally cleared bilateral repo. As the statistics above suggest, this segment of the market is primarily dealers engaging with customers, particularly levered funds like hedge funds. The closest comparable segment is therefore FICC’s Sponsored DVP Service, which also allows hedge funds to trade with dealers. Sponsored DVP has additional benefits because dealers can use clearing to net borrowing by hedge funds against lending by money market funds (MMFs). With this advantage, it may be surprising that dealers do so much of their business through non-centrally cleared repo. However, in our conversations with market participants they pointed to three advantages of non-centrally cleared bilateral repo:

- Market participants report that many institutions do not have access to sponsored repo, and that onboarding new sponsored members can be costly and time-consuming.

- Sponsored repo has until recently been limited to overnight Treasury collateral and non-MBS agency securities, so market participants point out that non-centrally cleared bilateral repo allows for a greater variety of trades.

- Trades by relative value hedge funds are often naturally netted, so novating them to FICC would not yield additional benefits. Meanwhile, market participants report that in non-centrally cleared bilateral repo, dealers can offer lower haircuts on these funding packages than would be imposed by FICC on sponsored trades.

These responses by market participants highlight the importance of the non-centrally cleared repo market and reinforce the need for more data regarding its functioning.

Next Steps

In addition to our outreach, the OFR began our pilot data collection with nine institutions. OFR’s pilot collection is designed to prepare industry participants and the OFR for a permanent data collection under a Final Rule, which will capture data on an ongoing basis across all market participants. Nine participants voluntarily shared data on their non-centrally cleared bilateral repo agreement transactions with the OFR for three days in June. The insights from this pilot collection will also help to support ongoing research about overall market stability and vulnerabilities that may emerge.

The OFR’s mission is to look across the financial system and shine a light into its dark corners. OFR’s research has shown that blind spots in repo markets have become more acute with recent events of repo market disruptions in September 2019 and March 2020.v Expanding visibility into the non-centrally cleared bilateral repo market will be a critical step toward filling this blind spot.

iOffice of Financial Research, “OFR Short-term Funding Monitor,” https://www.financialresearch.gov/short-term-funding-monitor

iiFor more detail on the segments of the repo market, see Baklanova, Viktoria, Adam Copeland, Rebecca McCaughrin, 2015. “Reference Guide to U.S. Repo and Securities Lending Markets,” Working Papers 15-17, Office of Financial Research, US Department of the Treasury; Kahn, R. Jay and Luke Olson, 2021. “Who Participates in Cleared Repo?,” Briefs 21-01, Office of Financial Research, US Department of the Treasury.

iiiOur estimates for non-centrally cleared reverse-repo prior to 2022 are obtained as a residual after taking out reverse-repo by primary dealers captured in the OFR’s cleared repo collection as well as an estimate of tri-party reverse-repo obtained by using the average share of tri-party repo in total reverse-repo since 2022 and extrapolating that on to pre-2022 total reverse-repo. This is comparable to the method employed in Copeland, A., Davis, I., LeSueur, E., & Martin, A. (2014). Lifting the veil on the US bilateral repo market (No. 20140709). Federal Reserve Bank of New York to estimate the total size of the bilateral (centrally cleared and non-centrally cleared) repo market for all participants.

ivThese match numbers reported by a contemporaneous note: see Infante, Sebastian, Lubomir Petrasek, Zack Saravay, and Mary Tian (2022). “Insights from revised Form FR2004 into primary dealer securities financing and MBS activity,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 5, 2022.

vSee Barth, Daniel and R. Jay Kahn, 2021. “Hedge Funds and the Treasury Cash-Futures Disconnect,” Working Papers 21-01, Office of Financial Research, US Department of the Treasury.