Rising Interest Rates Help Insurers, but Market Volatility Poses Risk to Some

Published: July 21, 2022

While the insurance industry has been subject to stresses recently, it is unlikely to affect the stability of the U.S. financial system in the near term. During the prolonged low-interest rate environment, certain investment strategies were adopted, widely, by insurers in an attempt to boost yields. However, enhanced yields do not come without trade-offs, such as increased risk and reduced liquidity. We explain three insurance industry investment trends of which policymakers should be mindful.

Rising interest rates generally help most insurers, but some insurers are more exposed to inflation

Modestly rising interest rates are generally positive for the insurance industry. When rates rise at a reasonable pace, portfolio yields also rise. With these new, higher-yielding corporate and other bond purchases, insurers’ investment earnings also increase. Life insurers, in particular, benefit from a rising interest rate environment as they’re likely to earn improved spreads over the cost of funding liabilities. Adding inflation to the mix, however, affects insurers differently. For example, while property and casualty (P&C) insurers also benefit from increased bond portfolio yields, higher-than-expected claim costs for home, automobile, and other insurance lines may impair earnings.

Strategies to improve yields may have increased credit and liquidity risks as well as interconnectedness

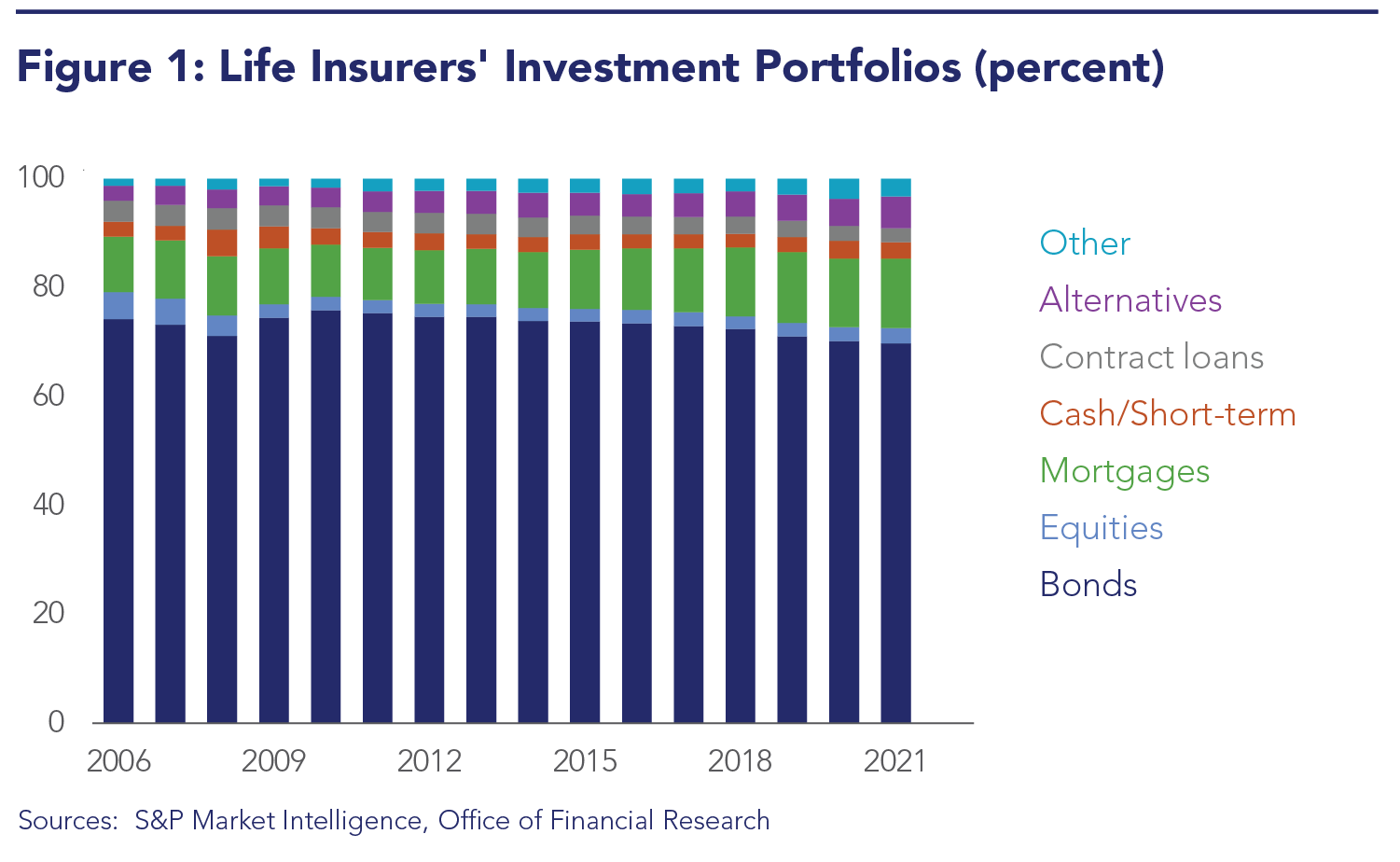

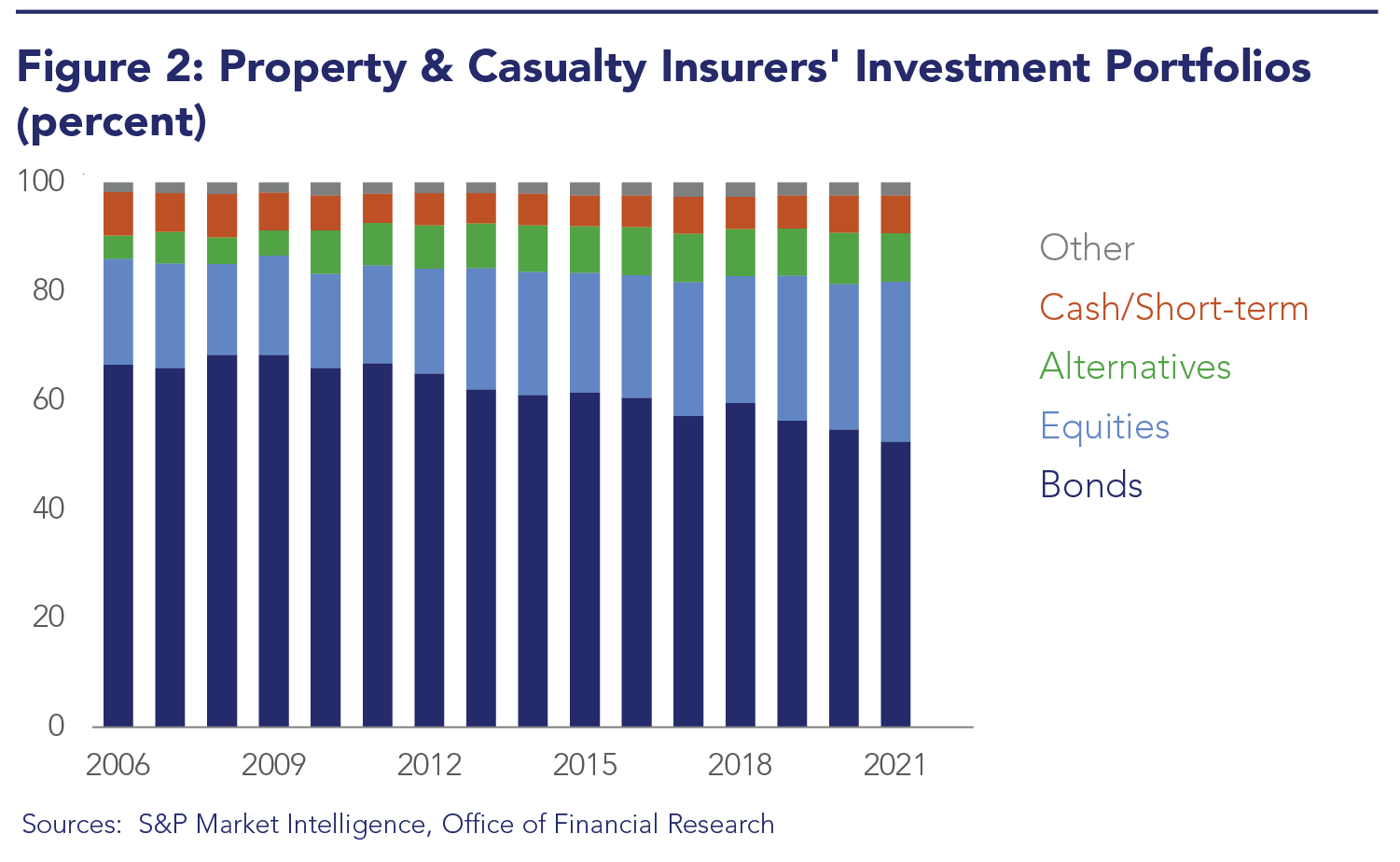

Life and P&C insurers increased their exposure to alternative assets, such as structured securities and commercial mortgage loans. Alternative assets may have improved portfolio yields, but they tend to be less liquid and expose insurers to greater credit risk. Compared to life insurers, P&C insurers hold a higher portion of their investment portfolios in equity securities, alternative investments, cash, and short-term investments (see Figures 1 and 2). The larger share of equity investments, for example, could expose P&C insurers to greater equity market volatility.

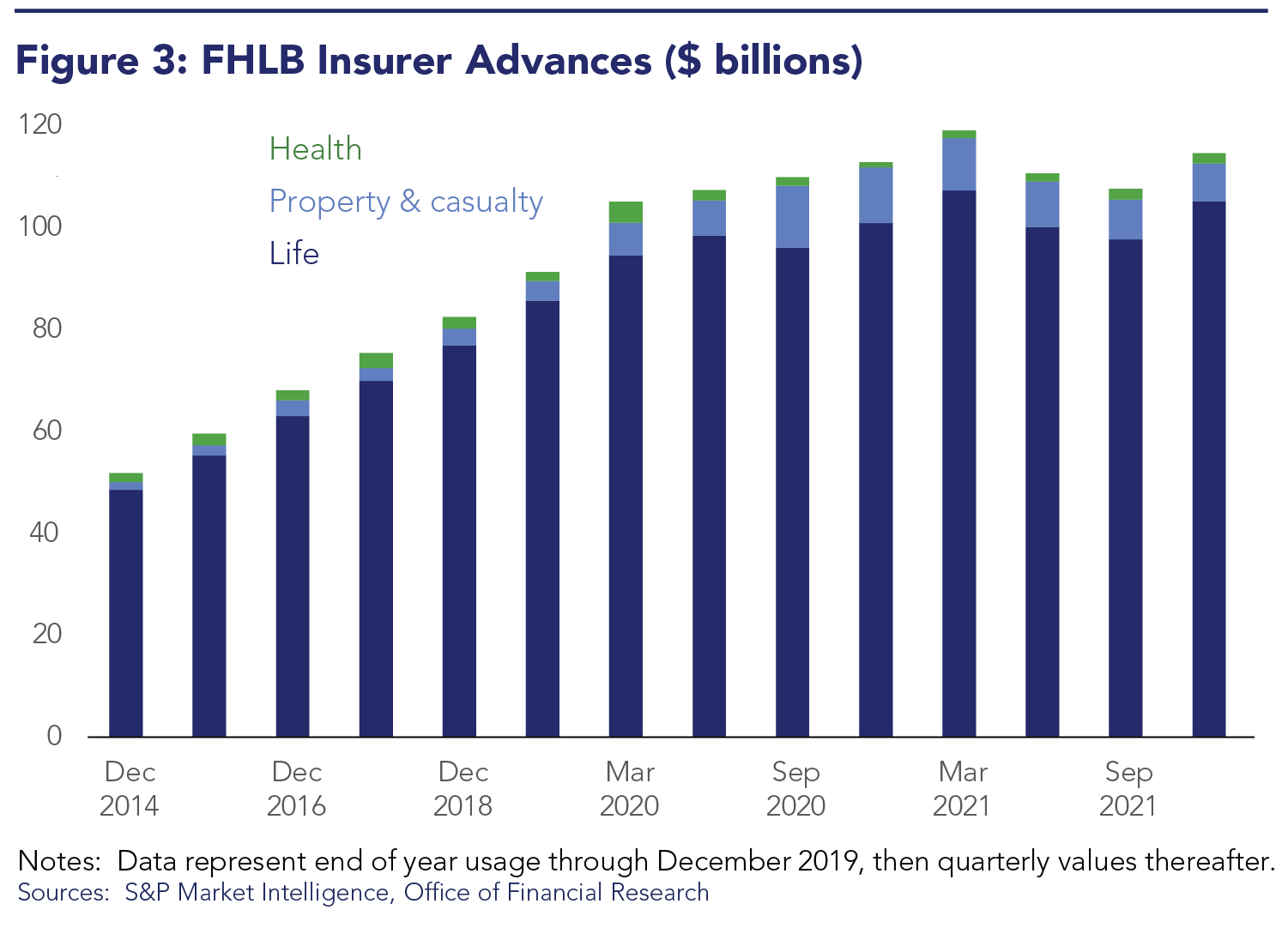

Additionally, the life insurance industry has been more active than others in the insurance industry in seeking strategies to boost investment yields. Strategies include using Federal Home Loan Banks (FHLBs) advances, which insurers have been rapidly expanding their use. A noticeable increase occurred during the first quarter of 2020 at the height of the COVID liquidity crisis (see Figure 3). Life insurers often use these advances as part of a spread arbitrage program where the advances are reinvested in higher-yielding assets. With the growing use by insurers, the FHLB system is becoming increasingly dependent upon insurers resulting in rising interconnectedness.

PE investors have an increasing presence and influence in the insurance industry

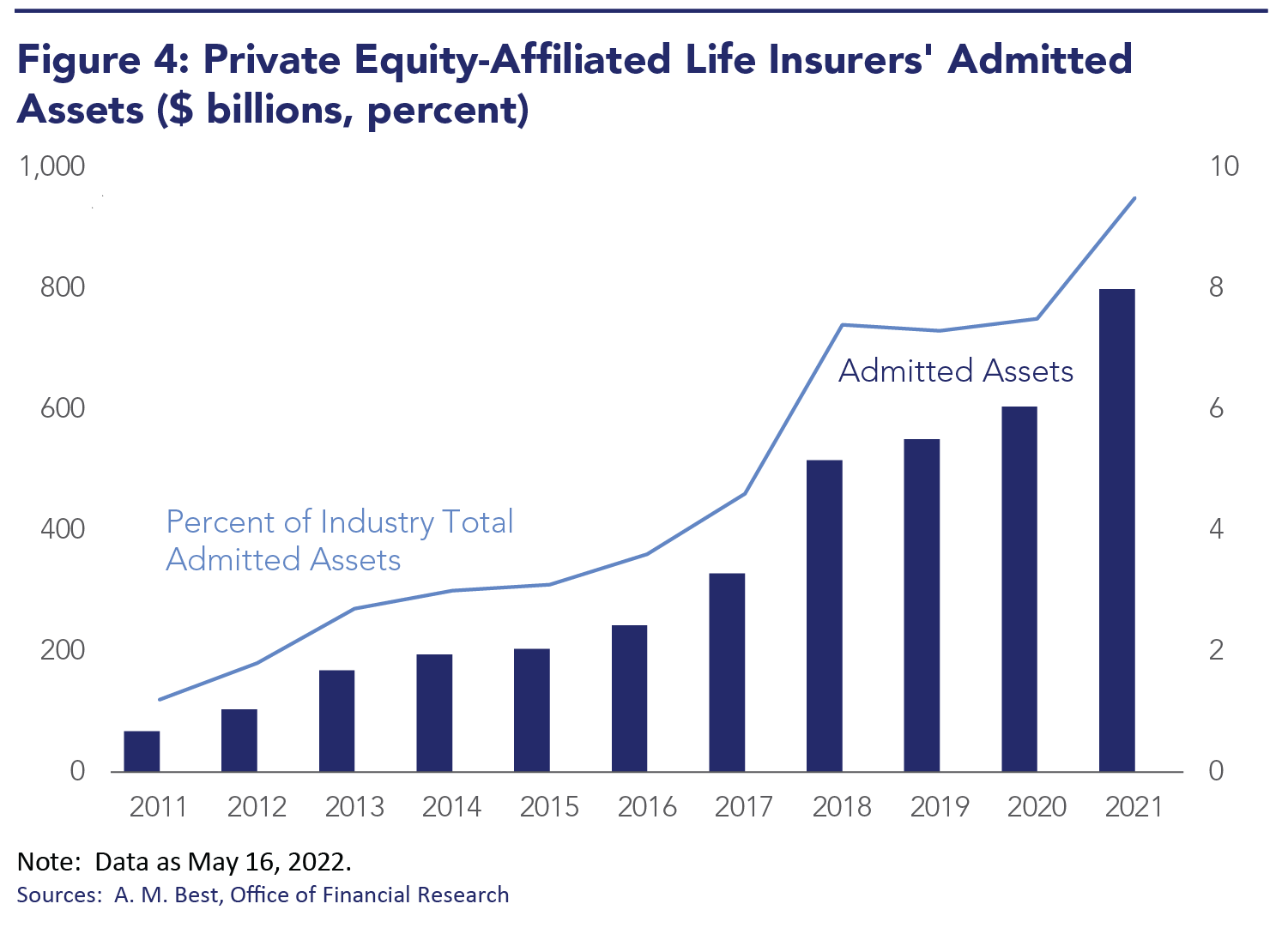

Private equity (PE) affiliated insurers have rapidly grown their presence in the life sector and have reached almost 10% of industry assets. PE firms participate in the life insurance industry to obtain liabilities, such as annuities backed by insurance reserves. The PE investors then reinvest the asset side of the balance sheet in collateralized loan obligations and other higher-yielding assets. PE growth has occurred via the acquisition of insurers, assuming existing business through reinsurance, and writing new business. Much of this business is eventually reinsured offshore, often to Bermuda-based reinsurers.

Insurers owned by PE firms have been actively developing new investment approaches designed to improve portfolio returns. As a result, PE-affiliated life insurers had a 74-basis point yield advantage over the total life insurance industry at year end of 2021 (see Figure 4). Enhanced yields, however, come with increased risk and reduced liquidity trade-offs.

The reach for yield significantly changed insurers’ investment strategies and increased the role of alternative investments, PE, and the FHLBs. As a result, while unlikely to impact the U.S. financial system, insurers’ investment portfolios have become riskier, especially among the more aggressive insurers. This may leave some insurers more exposed than others to market volatility that has accompanied rising interest rates.