Legal Entity Identifier System Gains Global Momentum

Published: January 14, 2014

As global acceptance continues to spread, governance for the Legal Entity Identifier (LEI) system advanced today. The LEI, like a bar code identifier for entities that engage in financial market transactions, promises to be a linchpin for making connections in the massive volumes of financial data that course through the international economy every day.

The Financial Stability Board (FSB), an international coordinating body established by the G-20 to promote global financial stability and regulatory coordination, endorsed today the nomination of 16 directors for the Global LEI Foundation (GLEIF), a key element for governance and a critical step forward.

The foundation, to be established in Switzerland, will build the technology infrastructure of the LEI system and be responsible for operational and quality controls assuring adherence to standards for reliability, quality, and uniqueness.

The LEI system’s Regulatory Oversight Committee established the legal underpinnings of the foundation, nominated the foundation directors, and requested that the FSB serve as the founder of the GLEIF. Last month, the committee and director nominees met in Basel, Switzerland, to begin their work.

This is just the latest work by the committee in overseeing the development of the LEI system. The appointment of the foundation directors is a strong indication that the LEI is here to stay around the world.

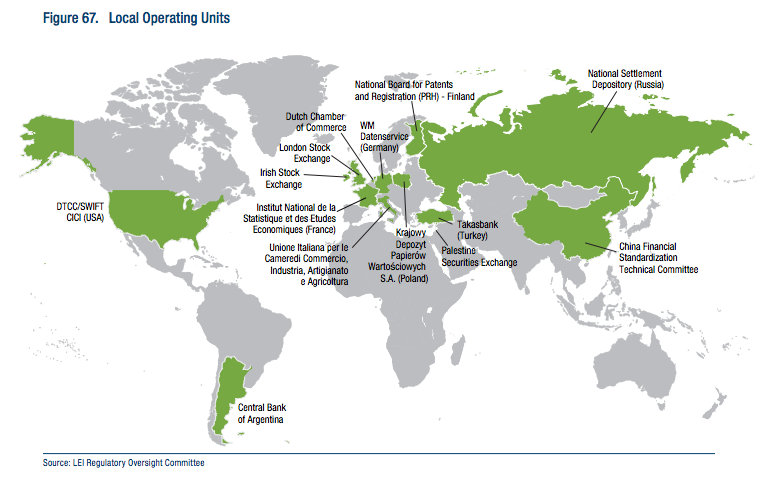

Look no further than the global map in the 2013 Annual Report of the Office of Financial Research (OFR) to see how many countries are developing interim “local operating units” to serve as registrars to assign LEIs to financial companies and each of their legal entities. To date, nine initial registrars have assigned more than 128,000 codes in 155 countries that will become full-fledged LEIs once the system is fully up and running (for details, see http://www.leiroc.org/).

Use of the LEI is expected to save enormous sums that the financial industry spends on cleaning and aggregating disparate data and on reporting data to regulators. Precise identification of counterparties would also give firms a clearer picture of their exposures in the marketplace.

For financial regulators, such identification would provide insight into ways shocks can spread across financial markets and would help in identifying vulnerabilities in the financial system.

Because of its tremendous potential value to promote financial stability, we are urging regulators in the United States and across the world to require financial firms to use the LEI in regulatory reporting.

The LEI is already required or proposed for use in swap data reporting in the U.S., Europe, and some parts of Asia; in private funds and insurance in the U.S.; and in bank reporting in Europe.

Such requirements will expand the footprint of the LEI, ultimately turning its “one golden standard” from vision to reality.

Matthew Reed is Chief Counsel at the Office of Financial Research and Chairman of the LEI system’s Regulatory Oversight Committee