Discussion Topic: OFR Financial Stability Monitor

Published: February 25, 2014

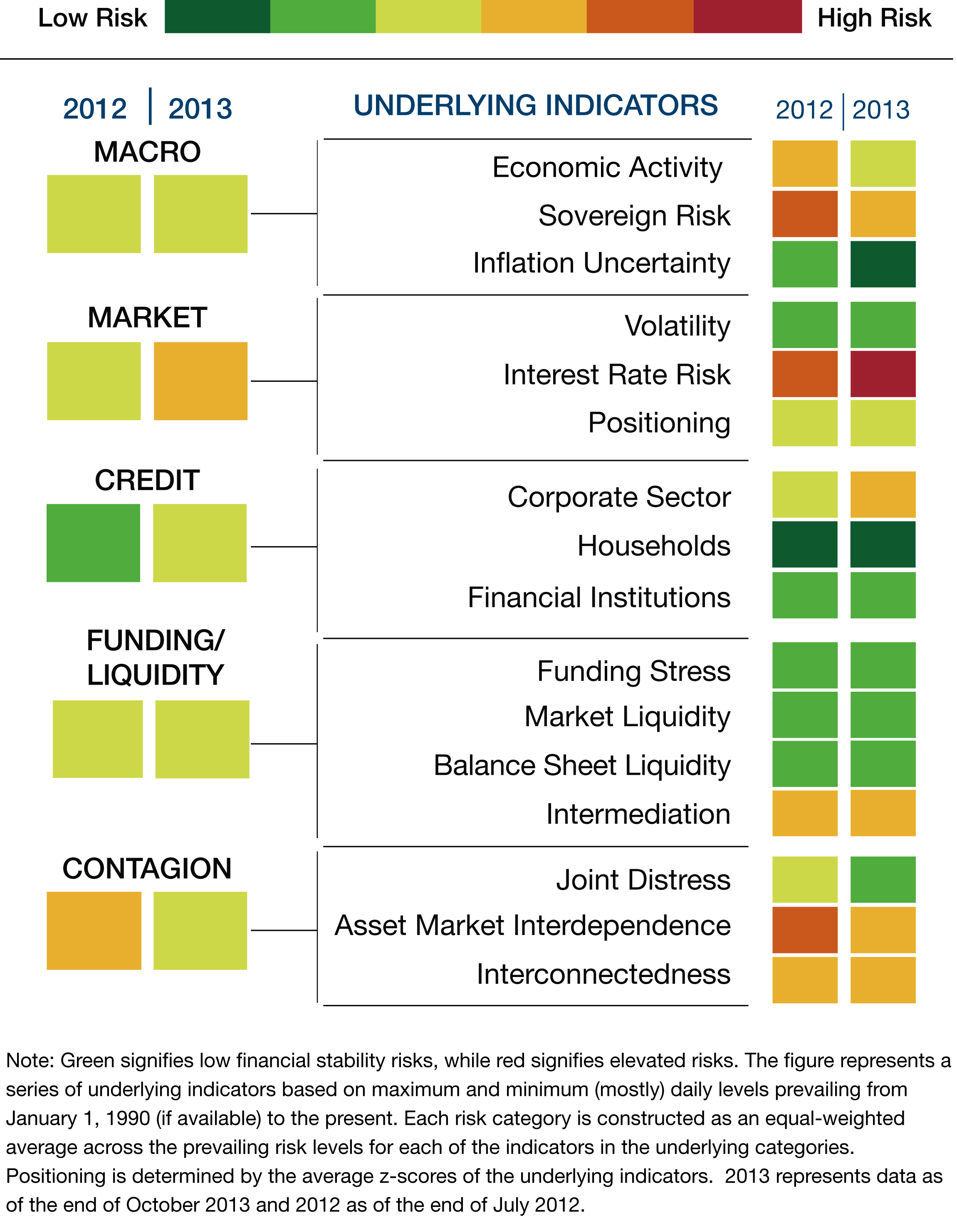

Since the financial crisis, evaluating risks to financial stability has evolved and gained prominence. Building on the existing research and toolkit, we have developed a framework for analyzing threats to financial stability that aims to provide policymakers with a periodic assessment of potential fragilities in the financial system. As part of this effort, we introduced a prototype Financial Stability Monitor in our 2013 annual report, which is intended to provide a snapshot or “heatmap” of five functional areas of risk – macroeconomic, market, credit, funding and liquidity, and contagion (Figure). Each risk category is measured using a mix of model-, market-, and survey-based indicators.

At the moment, the monitor suggests that risks have generally abated since our 2012 annual report, but there are a few pockets of vulnerabilities – notably excessive credit-risk taking in the corporate sector, EM financial and policy risks, and exposure to interest rate shocks.

We need to exercise a great deal of caution and humility about our ability to identify methods of forecasting systemic tail events. Therefore the monitor focuses on vulnerabilities in the financial system and not on predicting shocks to the system. In addition, it is intended to serve as a guide to policymakers rather than a mechanistic tool, and so will be accompanied by qualitative market surveillance. In short, we treat it as a starting point for highlighting potential weak links in the financial system that require further investigation.

Like any summary measure, our framework has limitations. First, the metrics we employ in the monitor are largely contemporaneous. Second, some risks are not currently quantifiable. Third, we recognize that the tool may have difficulty in identifying critical risk thresholds for policymakers and may not have the ability to capture the complexity of the financial system. The monitor will continue to evolve as we develop and test its performance, evaluate new indicators, data and statistical tools, and respond to the ways financial innovation may change intermediation, asset allocation, and risk management.

Discussion Questions:

-

Framework: Do the approach, range of risks, and key takeaways from the financial stability monitor resonate with the Committee? How does OFR’s framework compare to stability monitoring undertaken elsewhere?

-

Validity: Are there particular data sources, robustness tests, or other techniques that better capture systemic risks and could enhance the monitor? How do we approach measuring risks in areas such as operational risks and infrastructure risks?

-

Strategy: How should the monitor be used? Is there a better method for summarizing the results? How frequently should the monitor be updated?