Rising Confidence Lifts the U.S. Bull Market into its Eighth Year

Published: April 6, 2017

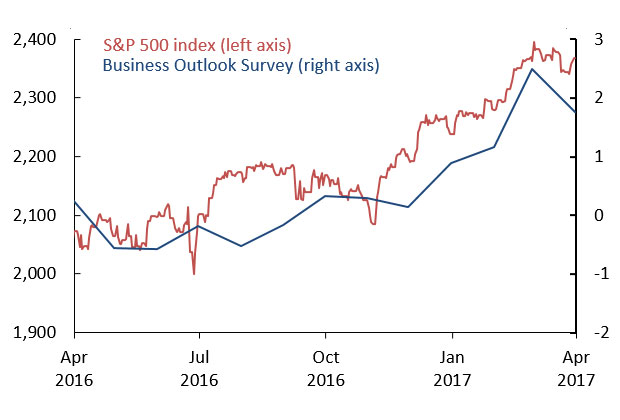

The bull market in U.S. stocks extended into its eighth year as major U.S. equity indexes rose during the first quarter, supported by an upswing in confidence, solid corporate earnings, and the expectation of faster U.S. economic growth. Equity market volatility and corporate bond spreads fell to near cyclical lows but stock valuations remained elevated.

Key developments in the first quarter of 2017

- Prices of risk assets generally appreciated as the bull market in U.S.equities started its eighth year. The bull market is supported by rising confidence, better-than-expected corporate earnings, and upbeat U.S. economic data.

- Corporate bond spreads tightened to near cyclical lows. Equity market implied volatility fell to a 10-year low.

- The Federal Open Market Committee (FOMC) raised short-term interest rates by 25 basis points in March, as expected. FOMC members projected two more rate hikes in 2017.

- In China, capital controls reduced capital outflows as official reserves increased. The currency appreciated against the U.S. dollar.