Initial Shock from U.K. Referendum Subsides

Published: October 6, 2016

Investors’ risk appetites quickly recovered in the third quarter from the initial shock of the United Kingdom’s vote to exit the European Union. The ultimate financial and political effects of the U.K.’s exit will take months or years to negotiate, and could introduce further confidence shocks to global markets.

Key developments in the third quarter of 2016

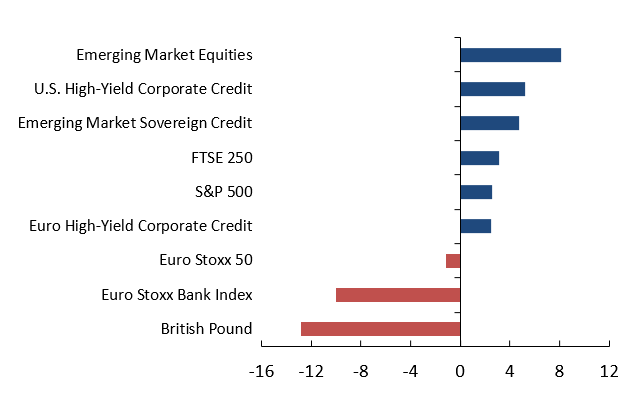

- Global risky assets recovered most of the losses triggered by the U.K. referendum (see Figure 1). The recovery was attributed to the absence of severe market dislocations after the vote, expectations for easier policy from major central banks, and continued stability in China’s economy and markets.

- A major reform of U.S. money market funds will take effect on October 14. In anticipation, assets in prime money market funds have fallen more than 40 percent in 2016. Divestments by prime funds have increased short-term U.S. dollar borrowing rates, most notably the London interbank offered rate (LIBOR). However, even with the increase, LIBOR and other U.S. interest rates remain at the low end of their long-term range.

- Emerging markets attracted capital from overseas investors during the third quarter, as interest rates in advanced economies remained at historically low levels. Oil prices rose on news that the Organization for Petroleum Exporting Countries informally agreed to cut production, but the market remains oversupplied. Oil prices are still 60 percent below their mid-2014 levels.

- Deutsche Bank’s equity price hit record lows on news of a potentially large fine from the U.S. Department of Justice. Global risk sentiment initially retreated and European financial stocks fell more than 7 percent.