United Kingdom Referendum Roils Markets

Published: July 14, 2016

The United Kingdom’s vote to leave the European Union was the defining focus of financial markets in the second quarter. Although the immediate market volatility has subsided, the policy uncertainty and the ultimate financial and political spillovers may last for months or years, leaving markets vulnerable to further confidence shocks.

Key developments in the second quarter of 2016

- The U.K. voted to leave the EU in a June 23 referendum. Although the referendum is non-binding, the U.K. government is expected to respect the result and formally move to exit the EU, commonly referred to as Brexit.

- Uncertainty remains about if, how, and when Brexit will be implemented. Its full effects on U.K. and European economies and financial systems will depend on those policy decisions, unfolding over the coming months and years.

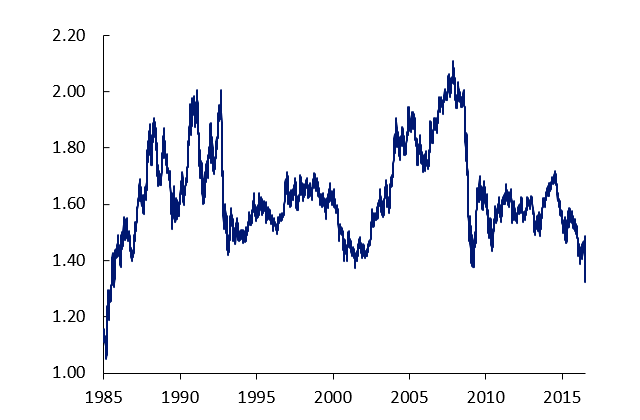

- Global risk assets sold off sharply in response to the vote. The U.K. currency and European financial stocks were hit hardest and they remain much weaker than before the vote (see Figure 1). The flow of investments to safe havens pushed long-term interest rates to historic lows in the United States, U.K., and Germany in late June and early July. On net, U.S. risk assets have since rebounded sharply, and equities in Europe recovered more than half their declines.

- Expectations of policies aimed at countering any post-referendum fallout and at shoring up the Japanese economy provided strong support for risk assets in the past two weeks. The yen in particular has retraced all of its post-referendum safe-haven rally.