Markets Tentatively Stabilize; Growth and Policy Concerns Persist

Published: April 12, 2016

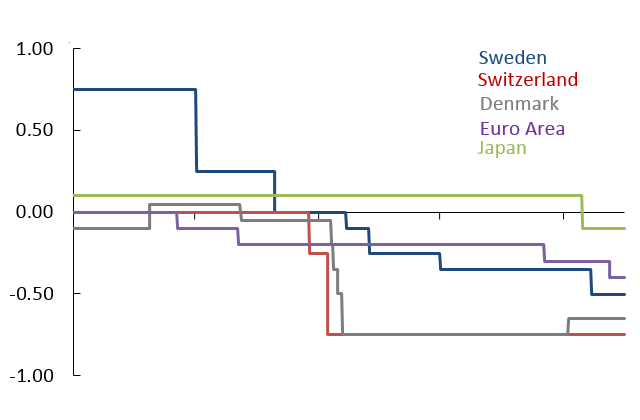

Global risk assets sold off sharply in the first six weeks of 2016. They have partly recovered, but the underlying themes of weak global growth outlooks, low oil prices, and uncertainty about policy options remain. This edition of the markets monitor discusses negative interest rates, the sell-off in bank stocks, and the high levels of U.S. stock valuations.

Developments in the first quarter of 2016

- In January, renewed concerns about Chinese economic policies and growth triggered sharp sell-offs in risk assets. Global markets for stocks and corporate bonds fell sharply. Plunging oil prices worsened the sell-offs.

- The Bank of Japan unexpectedly cut a key interest rate below zero in January (to -0.1 percent). That added to Japan’s aggressive policies to stimulate the weak economy and inflation. Many in the market expressed doubt that negative rates would be successful. The move renewed debates about whether monetary policymakers have run out of effective tools and whether negative rates do more harm than good.

- Many risk assets have had “relief rallies” since mid-February. The trigger was news of a potential oil production freeze by the Organization of the Petroleum Exporting Countries. More accommodative policy signals in the euro area, U.S., and China also contributed to the rally. By March 31, oil prices and leading indexes for U.S. stocks and corporate bonds had fully recovered from early-year losses. However, U.S. bank stocks and major foreign markets remain significantly weaker than they were at year-end, and long-term U.S. Treasury yields are again near historic lows.

- The European Central Bank announced monetary easing measures in March that exceeded market expectations. The Federal Open Market Committee (FOMC) released a new set of forecasts in March that was viewed as consistent with an easier path for policy.

- Market concerns that the United Kingdom may exit the European Union grew. A June date was set for a U.K. referendum on the matter, and some prominent politicians announced support for exit. The British pound fell to its lowest point against the dollar since early 2009.