Markets Weaken in Response to Concerns About Global Growth and Oil

Published: February 10, 2016

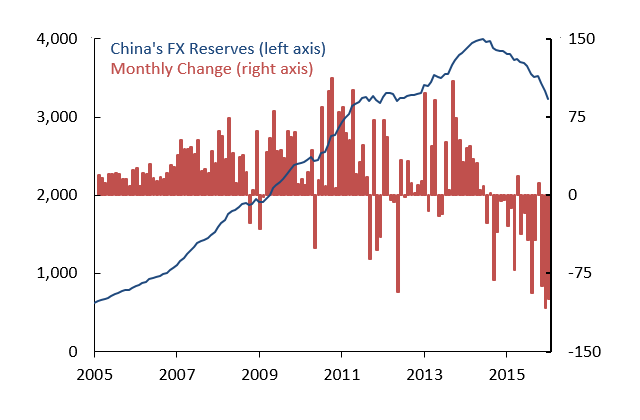

Prices of equities and other risky assets have declined markedly in 2016 due to concerns about global growth and low oil prices. Developments in China fueled market concerns about the effectiveness of Chinese economic policies, while oil oversupply pushed prices to lowest levels in more than 10 years. NOTE: After this issue, the Financial Markets Monitor will change to a quarterly schedule.

Developments since the November/December report

- Commodity prices fell further amid evidence of growing oversupply in oil markets and further weakness in global demand.

- Uncertainty about China’s policymaking increased because of authorities’ acceptance of greater currency depreciation and the failure of market circuit breakers to contain sharp declines in local equity markets.

- Global equity and corporate credit markets sold off sharply, and declines in emerging market currencies accelerated.

- The Federal Reserve began increasing interest rates as expected in December. It raised the federal funds target range 25 basis points. Global growth concerns and falling inflation since then have reduced market expectations of further rate hikes in 2016.

- The Bank of Japan unexpectedly cut its interest rate on excess reserves to negative 10 basis points in pursuit of its 2 percent inflation target.