Uncertainty Increases in Greece, But Signs of Contagion Remain Limited

Published: July 8, 2015

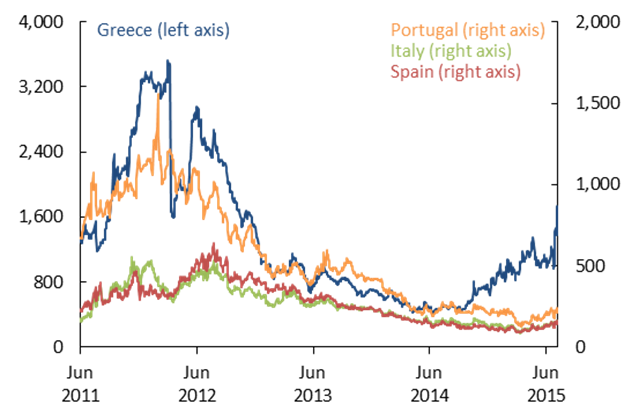

Important developments in Greece, a sharp equity market correction in China, and Puerto Rico’s announcement of a potential debt restructuring have driven risk sentiment in financial markets. A key market focus has been the increased uncertainty in Greece since late June. Developments there remain fluid; a more disorderly outcome may test the stability of broader euro area markets.

Developments since the May report

- Greece’s negotiations with official creditors broke down; events remain fluid and the outcome uncertain.

- Puerto Rico’s government signaled a potential restructuring of its debt, triggering a sharp sell-off of its bonds and underperformance of exposed bond insurers. Spillover to the broader municipal debt market was limited.

- Chinese equities posted a large sell-off, partially reversing their outsized rally and weighing on regional markets and commodities.

- Long-term advanced economy bond yields rose further in early June, before partially retracing amid uncertainty in Greece and Chinese equity declines.

- The latest meeting of the Federal Open Market Committee (FOMC) was perceived by market participants as dovish; analysts continue to expect the first interest rate hike to occur in September or December.