Divergent Monetary Policies Continue to Drive Market Trends

Published: March 31, 2015

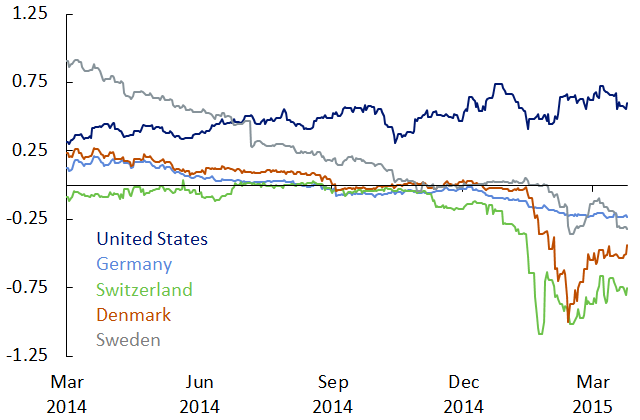

The divergence of global monetary policies remains a dominant theme, driving important market trends. While the Federal Reserve is expected to tighten policy, many other central banks are undertaking additional easing. The expansion of quantitative easing programs and negative interest rates — which may be justified to prevent economic stagnation — entail financial stability risks that warrant monitoring and, where possible, mitigation.

Developments since last month

- The euro weakened further and euro area assets rallied as the ECB began its government bond purchases

- The U.S. dollar continued to appreciate; investor positioning and options suggest markets expect further gains

- U.S. Treasury yields declined and U.S. equity prices remained near record highs after the March Federal Reserve meeting, the statement and projections from which were considered more accommodative than expected

- Oil prices continued to trade near multiyear lows