Testimony of OFR Chief Operating Officer Michele Shannon before the House Financial Services Subcommittee on Oversight and Investigations

Published: April 19, 2012

Hearing title: Budget Hearing – Office of Financial Research

Introduction

Chairman Neugebauer, Ranking Member Capuano, and other members of the subcommittee, thank you for the opportunity to be here today and to testify about the progress that the OFR is making to fulfill its mission and carry out its statutory responsibilities.

The OFR has made substantial progress since this subcommittee’s oversight hearing on the Office nine months ago. In my testimony today, I will discuss the mission of the OFR, explain our strategic goals and the steps we are taking to achieve them, and review the OFR budget and funding.

Mission

The Dodd-Frank Act established the OFR to serve the Financial Stability Oversight Council (Council), its member agencies, and the public by improving the quality, transparency, and accessibility of financial data and information, by conducting and sponsoring research related to financial stability, and by promoting best practices in risk management.

Although there will always be a fundamental uncertainty about the source of threats to financial stability, the basic idea underlying the OFR’s mandate is that better data and analysis can support the design of stronger financial shock absorbers and guardrails to reduce the risk of crises. They can also support earlier warning and effective responses to reduce the effects of crises when they occur, and help draw lessons for the future.

Strategic Goals and Work to Achieve Them

The OFR has made substantial progress over the last nine months in its stand-up. A Strategic Framework is now in place to guide our way forward, we are seeing accelerated progress in building the OFR’s staff and institutional infrastructure, and we are beginning to deliver on our data and research related mandates.

The Strategic Framework, published on March 15, 2012, establishes five goals for the OFR:

- Support the Council through the secure provision of high-quality financial data and analysis needed to monitor threats to financial stability.

- Develop and promote data standards and best practices.

- Establish a center for excellence for research on financial stability and promoting best practices for risk management.

- Provide the public with key data and analysis, while protecting sensitive information.

- Establish the OFR as an efficient organization and world-class workplace.

These goals tie to our mission, and the work we have done in the last nine months focuses on accomplishing the goals in support of that mission.

1. Support the Council through the secure provision of high-quality financial data and analysis needed to monitor threats to financial stability.

The OFR has begun to support the Council and its member agencies by providing analyses and data-related services. For example, the OFR is providing data for use by the Council in developing its Annual Report on financial stability, as well as broader data-related procurement and support.

The Office is also providing analytic input for the Council’s analysis, such as data and analysis related to designation of nonbank financial companies for consolidated supervision by the Federal Reserve Board. The OFR is also actively working with Council member agencies and staff to develop and maintain an initial “dashboard” of metrics and indicators related to financial stability, initially drawn from previous academic research and the Council’s 2011 Annual Report.

The OFR fully recognizes the need to be thoughtful and judicious in fulfilling its data-related mandate. The OFR will not duplicate existing efforts. Rather, it will collect data only when necessary to assess threats to financial stability and only when the data are not otherwise available. At the same time, the OFR will seek to create new efficiencies through collaboration with other Council member agencies to eliminate redundant reporting requirements across the regulatory system.

As a first step, the OFR is establishing an inventory of data held by Council member agencies. A first phase—an inventory of purchased data—has been completed, and a second phase on collected data has been initiated. The OFR has also begun work to improve data quality and processing efficiency and to broaden data availability among the Council and member agencies.

A key vehicle to support collaboration on data-related issues is the Council’s Data Committee, which the Council established to support data collection and information sharing, as well as to provide direction to, and request data from, the OFR. The committee also supports working teams on topics relevant to the Council, such as data classification among Council members and input on the “dashboard” noted above.

2. Develop and promote data standards and best practices

The OFR is promoting stronger data-related standards to improve the quality and scope of financial data, which in turn should help regulators and market participants mitigate risks to the financial system. Such standards will also help firms link and aggregate information more easily and allow them to use the same basic data for reporting to regulators and for managing their businesses—providing important efficiencies and cost-savings.

A key early initiative of the OFR is its ongoing work with policymakers, regulators, and the private sector to establish a unique, global standard for identifying parties to financial transactions. This Legal Entity Identifier (LEI) will allow for better understanding of true exposures and counterparty risks across the system—to the benefit of both market participants and regulators. The OFR is taking an active role in the process led by the international Financial Stability Board, which will deliver concrete proposals on the implementation of an LEI system to the G-20 at its Summit meeting in June 2012. The OFR is also working with Council member agencies to ensure readiness for the LEI and to support its adoption.

Looking forward, the OFR will broaden its agenda to promote other global data-related standards when those standards enhance the ability to identify and mitigate threats to financial stability, and assist Council member agencies in defining standards and best practices for their own data collection and management.

3. Establish a center for excellence for research on financial stability and promote best practices for risk management

The OFR is working to create a collaborative environment for conducting, coordinating, and sponsoring research and analysis on risks to financial stability and best practices for risk management. This effort is already producing results:

-

The OFR released the first paper of its Working Paper Series in January 2012—A Survey of Systemic Risk Analytics—focusing on quantitative tools for assessing threats to financial stability. Last month, the Office issued the second paper in the series—Forging Best Practices in Risk Management—providing a broad assessment of risk management practices and how risk management can be improved. The OFR is inviting researchers and other interested parties to review this work.

-

In December, the OFR teamed with the Council to host a conference entitled, “The Macroprudential Toolkit: Measurement and Analysis” in Washington, D.C. The conference brought together thought leaders from the financial regulatory community, academia, public interest groups, and the financial services industry to discuss issues related to data, technology, and analytical approaches for assessing, monitoring, and mitigating threats to financial stability.

-

Last fall, the OFR launched a Research Seminar Series, inviting researchers in academia, government, and the private sector to present findings on a range of topics related to the OFR’s mission. As of April 9, the Office has hosted 17 widely attended meetings.

-

On March 22, 2012, the OFR announced plans to create the Financial Research Advisory Committee of distinguished academics, researchers, industry leaders, government officials, and experts in the fields of data and technology. The committee will serve as a valuable resource for broadening the OFR’s analytical perspective and provide a critical link to diverse knowledge, experience, and perspectives.

During the remainder of FY 2012, the Office will conduct studies—in conjunction with the staffs of Council member agencies and on its own—and provide advice on the market impact of policies related to threats to financial stability, e.g., on funding markets and interconnections across the financial system. Over time, the OFR will also develop and disseminate analyses of risk management tools on topics such as stress testing, contingent capital, robust risk measurement, methods for quantifying counterparty risk in derivatives markets, and models of the propagation of risk through financial linkages.

4. Provide the public with key data and analysis, while protecting sensitive information

The Office is required under Dodd-Frank to make non-sensitive data and information available to the public, and to protect sensitive information. Both are essential for the OFR to fulfill its mission.

As noted above, the Office has taken initial steps in fulfilling its publication mandate by issuing its first two working papers, making accessible the OFR’s in-depth work to analyze and measure threats to financial stability. The OFR also publicly released presentations, copies of remarks, and other materials associated with its “Macroprudential Toolkit” conference in December. In addition, the Office will make original research and analysis public through its first Annual Report to Congress in July. The report will discuss the Office’s strategy for filling gaps in the research and data needed to identify, assess, and monitor threats to financial stability.

OFR recognizes that secure data collection and storage are essential to fulfilling its mission, and has emphasized data protection throughout its organizational development activities. As an office within the Treasury, the OFR inherits the benefits of the Treasury Department’s secure information technology infrastructure. The OFR is also adhering to the security policies of the Treasury’s Chief Information Officer. The OFR plans to expand its security controls as necessary for OFR-specific systems and data, as well as for information sharing across Council member agencies.

The OFR will grant and administer access based on pre-defined roles and will monitor usage to confirm that proper controls are in place based on the identified and assigned classification of data. In addition, OFR employees who are handling highly sensitive, confidential data will need to sign an acknowledgement that they will be subject to a one-year post-employment restriction from working for a financial services entity, unless a waiver is granted as detailed in the interim rule published in the Federal Register on Sept. 30, 2011.

5. Establish the OFR as an efficient organization and world-class workplace

Human Resources

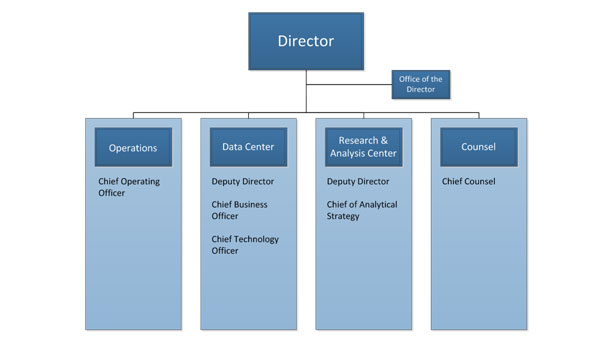

The OFR is committed to building an effective workforce environment, engaging its workforce to achieve organizational success, and supporting its mission in a cost-effective way. The Dodd- Frank Act established the organizational structure of the OFR with a Director heading the Office and overseeing two core centers—the Research & Analysis Center and the Data Center. The OFR also has support offices for Operations and Chief Counsel.

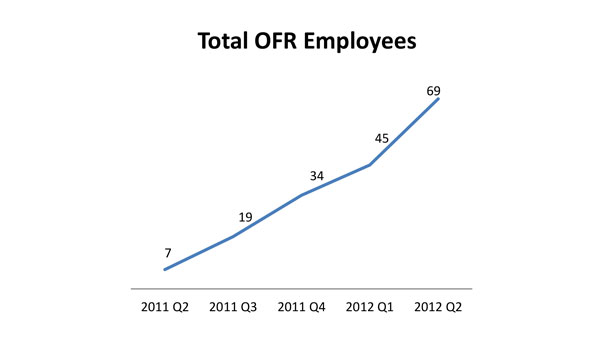

The Office has made strong progress in establishing its leadership team, with five of eight senior positions filled: a Chief Business Officer of the Data Center (also acting as Deputy Director), the Chief Counsel, Chief Operating Officer, Chief of Analytic Strategy, and acting Chief Technology Officer. As of April 9, the OFR had a staff of 69, including seven employees on detail from other agencies, and the commitment of resources from the Treasury in the areas of budget, financial management, information technology, human resources, procurement, and facilities planning.

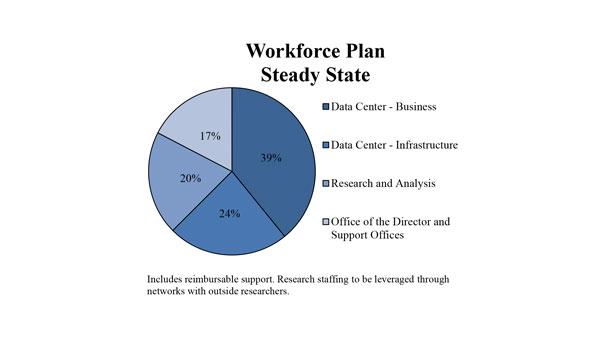

The OFR plans to build to steady state staffing levels of 275-300 FTEs within the next 24 to 36 months. More than 60 percent of these employees will be in the Data Center. The Research & Analysis Center will constitute about 20 percent of the OFR’s staff and will leverage a broader network of resources through work arrangements with outside researchers and collaboration with Council member agencies. The Office of the Director, Counsel, and Operations will make up the remaining staff.

Financial Management

The OFR’s financial activities are subject to general Treasury financial management controls and protocols and are reviewed as part of the broader audit of Departmental Offices within the Treasury. The OFR’s budget is published with the President’s Budget. The OFR has also developed expanded internal policies and procedures to support sound and efficient operations, and rigorous internal controls, including through a program management office. In addition, the Office of the Inspector General and the Government Accountability Office periodically audit the OFR’s activities and the Director of the OFR will testify to Congress annually on these issues.

Information Management

As we stand up the OFR, a key focus is building the infrastructure for information technology and business systems to provide for: (1) data acquisition, management, and dissemination under strict protocols for security and data sharing; (2) a robust research and analytical environment capable of handling large amounts of data to support complex financial models, computations, and analysis; and (3) a secure platform for collaboration and communications with Council member agencies and outside researchers, as well as for broader communication with the public on OFR activities.

As a first stage, the OFR has established a foundational analytics environment to support the short-term needs of researchers and analysts. The OFR is also pursuing pilot projects as part of its broader planning process for systems to meet longer-term needs. Consistent with the OFR’s commitment to a careful and prudent approach to its expenditures, this planning includes measures to refine and validate estimates for costs and timing. This planning is well advanced, and implementation is expected as soon as the end of the year.

Budget and Funding

The complex, highly specialized mission of the OFR and the scope of the task to establish the Office from the ground up both dictate that the OFR take a careful, prudent approach to its budget and funding. To stand up the OFR correctly, the Office is tightly linking its expenditures to its mission, ensuring that we are good stewards of the funds entrusted to us. Our careful approach contributed to the fact that the OFR spent less in FY 2011 than budgeted, with obligations totaling $11.3 million.

| Table 1. OFR Spending to Date, by Source -- in millions | ||||||

|---|---|---|---|---|---|---|

| | FY2011 | FY2012 Q1 and Q2 | Total Spending through 3/31/12 | FY2012 | FY2013 | |

| Personnel | $2.2</strong> | $4.4</strong> | $6.6</strong> | $28.2</strong> | $45.7</strong> | |

| Salaries and Benefits of Direct Hires | $0.7 | $2.7 | $3.4 | $24.7 | $41.4 | |

| Other Personnel (i.e. Reimbursable and Detail Contracts) | $1.5 | $1.6 | $3.1 | $3.5 | $4.3 | |

| OTHER EXPENSES | ||||||

| Research & Analysis | $0.5 | $0.3 | $0.8 | $3.0 | $3.2 | |

| Data Center | $4.1 | $5.3 | $9.4 | $47.5 | $67.0 | |

| Office of the Director and Support Offices | $4.5 | $10.4 | $14.9 | $31.0 | $22.4 | |

| Total OFR Obligations | $11.3 | $20.4 | $31.7 | $109.7 | $138.2 | |

The pace of spending is projected to pick up significantly in the second half of FY 2012 and FY

- In the FY 2013 President’s Budget, OFR spending is projected at $109.7 million for FY 2012 and $138.2 million for FY 2013. Table 1 details the main budgeted expenditures of the OFR:1

-

Personnel – Salaries and benefits of employees, reimbursable support, as well as reimbursement costs for employees detailed to the OFR;

-

Research & Analysis – Contracts and other work arrangements with outside researchers;

-

Data Center – The build-out of the information technology infrastructure and processes to support analysis and collaboration; includes establishing a robust security framework to protect the integrity of financial data; also includes procurement of commercially available financial data;

-

Office of the Director and Support Offices – Administrative support, travel, supply, equipment costs, rent, and renovation of permanent office space.

The Dodd-Frank Act mandates that the Board of Governors of the Federal Reserve System funds the OFR for the first two years following enactment. Beginning on July 21, 2012, the OFR (along with the Financial Stability Oversight Council and certain expenses of the Federal Deposit Insurance Corporation) is to be funded through assessments on bank holding companies with total consolidated assets of $50 billion or greater and nonbank financial companies designated by the Council for supervision by the Board. In a Notice of Proposed Rulemaking issued on January 3, 2012, Treasury proposed to establish that assessment schedule. The comment period on the proposed rule has closed; publication of the final rule is expected in May.

As of March 31, 2012, the OFR has received $39.3 million in transfers from the Federal Reserve, with obligations of $31.7 million at the end of the second quarter of FY 2012 (Table 2).

| Table 2. OFR Funding Transfers from the Federal Reserve – in millions | |||||||

|---|---|---|---|---|---|---|---|

| | FY2011 | FY2012 | Total Through Q2 FY2012* | ||||

| | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | –– |

| Transfers from FRB | $2.1 | $0.0 | $11.0 | $0.0 | $26.2 | $0.0 | $39.3 |

| Quarterly Spending | $0.0 | ($0.3) | ($2.5) | ($8.4) | ($3.3) | ($17.1) | ($31.7) |

| End of Quarter Balance | $2.0 | $1.6 | $10.2 | $1.8 | $24.3 | $7.6 | –– |

*An additional transfer request for $37 million was made on April 13, 2012.

Conclusion

Chairman Neugebauer and members of the Committee, the OFR has made significant progress since your hearing last July and the pace of progress is accelerating.

Thank you again for the opportunity to be here today. I would be happy to answer your questions.

-

This table differs from data referenced in the Congressional Justification (CJ) for the Financial Research Fund in support of the FY 2013 President’s Budget in two key respects. First, the CJ presentation of obligations by object classification includes consolidated figures for expenses under the Financial Research Fund for the OFR and FSOC, as well as certain covered expenses of the FDIC, whereas this table covers the OFR only. Second, the presentation in the CJ uses standard object class categories, whereas this presentation uses a functional breakdown by OFR office. The three largest line items in the presentation in the CJ are: (1) “Other Contractual Services” ($60.7 million for FY2012, including $52.7 million for the OFR; and $72.3 million in FY2013, including $58.3 million for the OFR); this object class includes consulting services, interagency agreements, training, and O&M costs; (2) “Supplies and Materials” ($5.2 million in FY2012, including $5.1 million for the OFR; and $10.2 million in FY2013, including $10.1 million for the OFR); this object class includes office supplies, publications, and data subscriptions; and (3) “Equipment” ($21.6 million in FY2012, including $21.3 million for the OFR; and $22.4 million in FY2013, including $22.1 million for the OFR); this object class includes office equipment, telecommunications, and IT equipment. ↩