Long-term Price Growth and Household Financial Conditions

Published: May 20, 2025

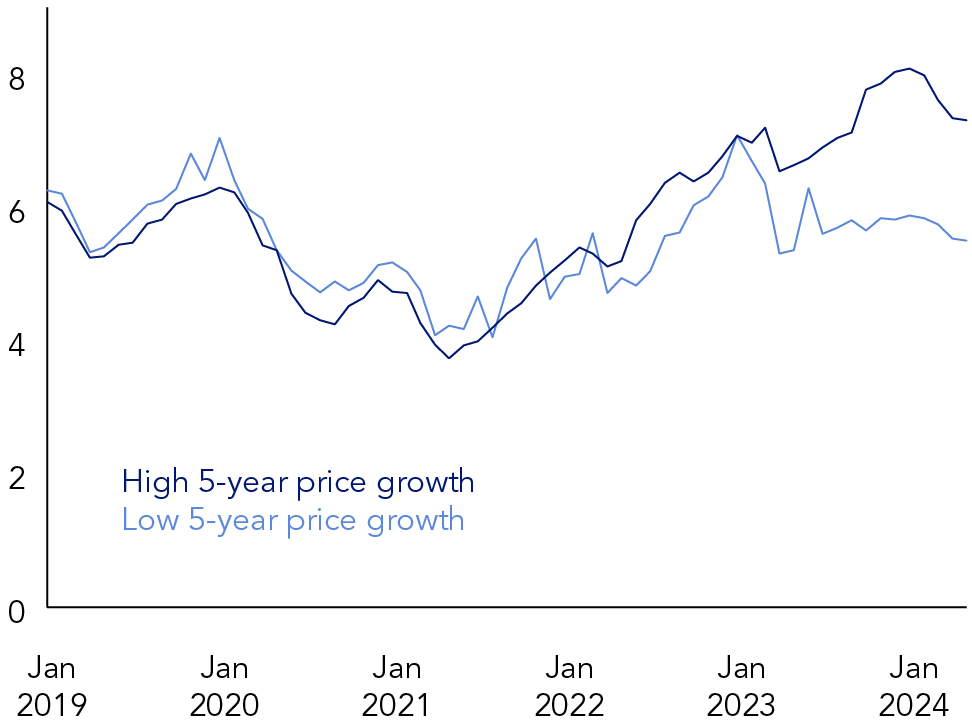

Delinquency rates for non-mortgage consumer debt have increased since 2021, raising concern about financial risks in the household sector. Consumers have faced historically high price growth during this same period, which could lead to difficulty making debt payments. This brief examined the relationship between persistent inflationary pressures and rising consumer debt delinquency rates. The analysis finds that consumers living in areas with higher long-term price growth have had higher delinquency rates in recent years. This relationship is particularly strong for growth in shelter prices, especially among renters. High long-term price growth may contribute to rising delinquency rates through strains on household balance sheets (Brief no. 25-02).