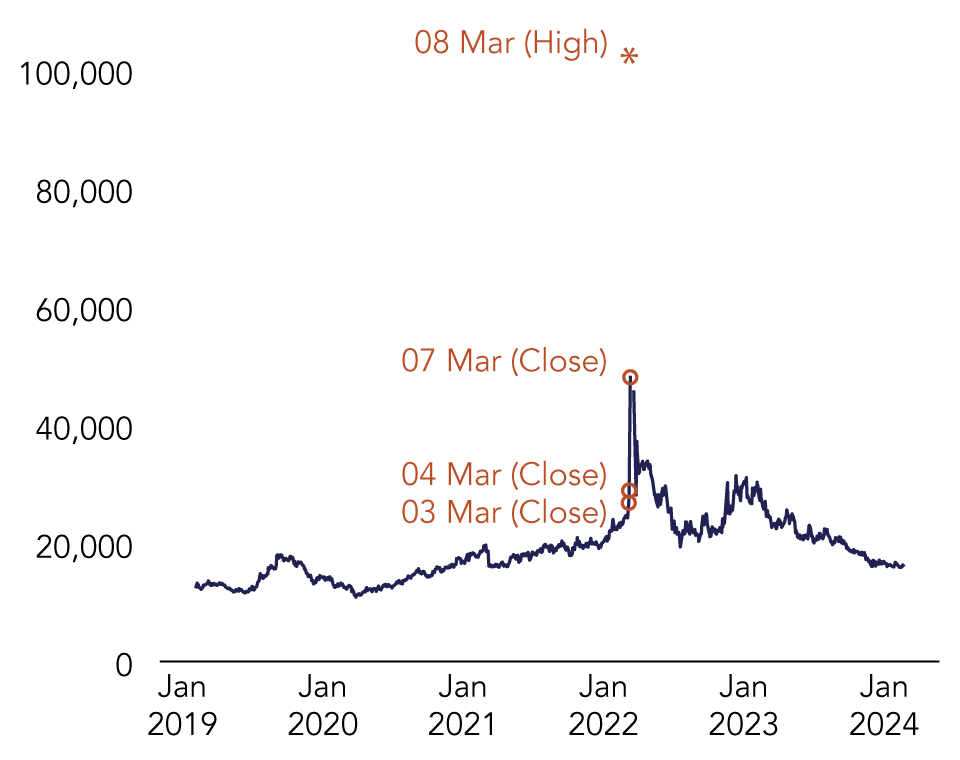

Lessons from Trade Cancellation at the LME in March 2022

Published: May 8, 2025

Mass trade cancellation is a novel risk management tool used by the LME during the March 2022 episode of nickel market stress. Subsequent court decisions upheld the cancellations. This brief revisits the episode and identifies key insights for CCP risk management more broadly. Specifically, poorly managed client trading can threaten financial stability. Trade cancellation can avoid mass defaults but conflicts with contract performance, a critical function of CCPs. CCP loss allocation procedures remain largely untested (Brief no. 25-01).

View related working paper: Central Clearing and Trade Cancellation: The Case of LME Nickel Contracts on March 8, 2022