Treasury Market Stress: Lessons from 1958 and Today

Published: June 9, 2022

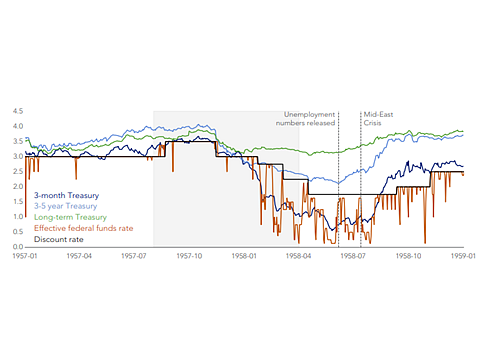

While the stress Treasury markets experienced in March 2020 took many by surprise, it was not unprecedented. This brief examines a similar episode of Treasury market stress that took place in the summer of 1958. Although different events triggered these episodes, the brief shows that they have many similarities in terms of the vulnerabilities they exposed: a high level of outstanding debt, dealers overloaded with Treasury securities, large positions (sometimes with minimal haircuts) funded using leverage in the repo market, a prevalence of carry trades, and sudden increases in margins. The discussion in the brief covers the expansion of market-based financing in the Treasury market over the 1950s, including how it was driven by demands for short-term and highly liquid investment mediums from outside the financial sector. Finally, it reviews the challenges for reform policymakers faced in the wake of the crisis. (Brief no. 22-01)