Benefits and Risks of Central Clearing in the Repo Market

Published: March 9, 2017

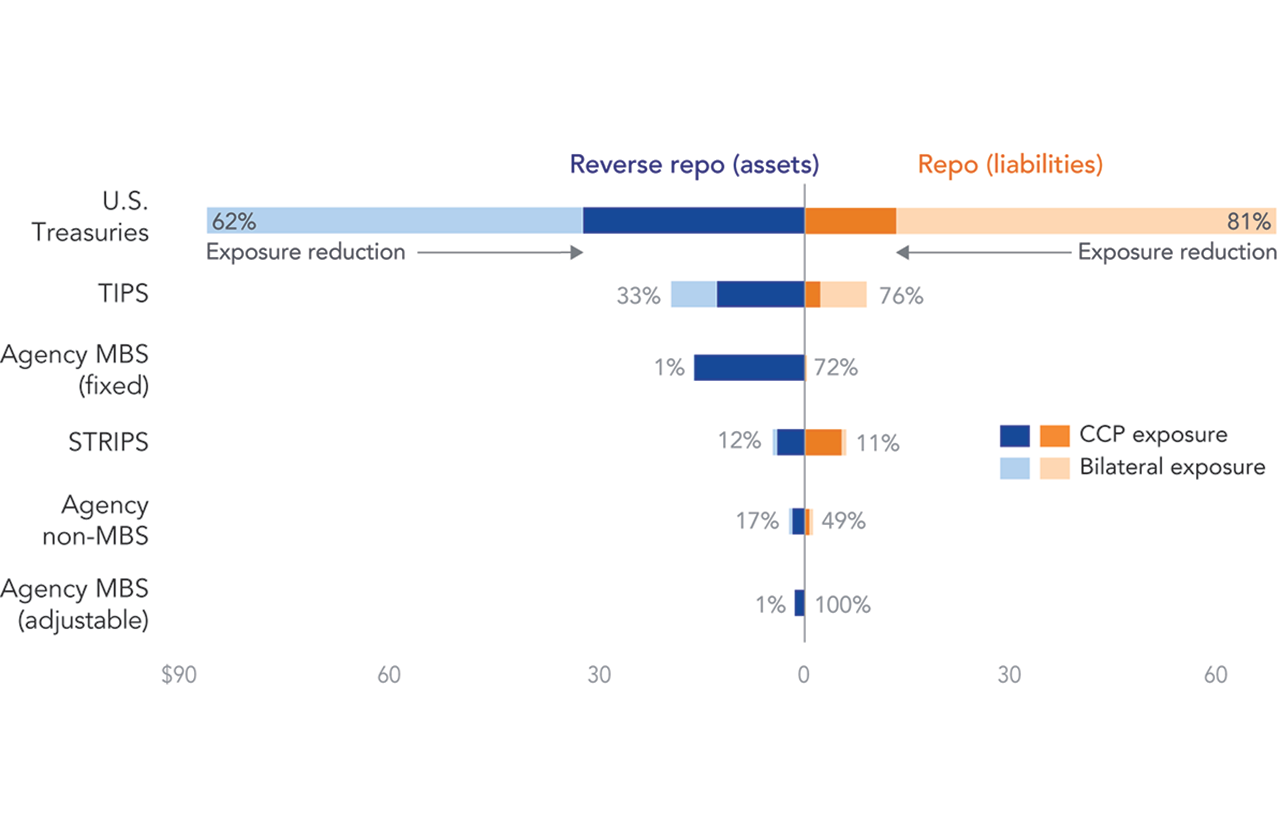

The repurchase agreement (repo) market is a major source of short-term funding in the financial system. Many repo transactions between dealers are centrally cleared. This brief, using data from the OFR’s interagency bilateral repo data collection pilot, finds economic benefits for dealers in expanding central clearing to transactions between dealers and nondealer clients, but increased risks to the central counterparty. (Brief no. 17-04)