Capital Buffers and the Future of Bank Stress Tests

Published: February 7, 2017

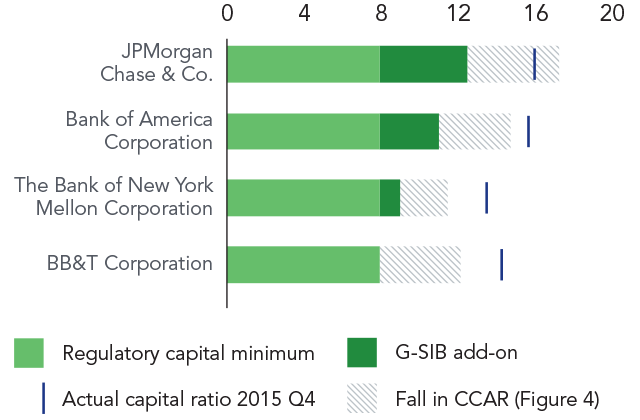

U.S. bank regulators are phasing in new capital buffers to cushion against shocks. Systemically important banks will hold three buffers, while most banks will hold one. The Federal Reserve may integrate the buffers into stress tests. As a result, some banks would hold more capital. Without the change, stress tests could have a bigger impact on less systemic banks. Another proposal could make stress tests less effective. (Brief no. 17-02)