Central Bank Digital Currency: Stability and Information

Published: July 11, 2022

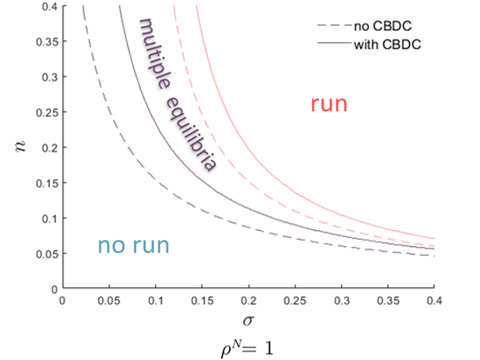

One often cited concern about central bank digital currency (CBDC) is that it could make runs on banks and other financial intermediaries more common. This working paper identifies two ways a CBDC may enhance rather than weaken financial stability. First, banks do less maturity transformation when depositors have access to CBDC, reducing their exposure to depositor runs. Second, monitoring the flow of funds into CBDC allows policymakers to react more quickly to periods of stress, which lessens the incentive for depositors and other short-term creditors to withdraw assets (Working Paper no. 22-04).

Abstract

We study how introducing a central bank digital currency (CBDC) would affect the stability of the banking system. We present a model that captures a concern commonly raised in policy discussions: the option to hold CBDC can increase the incentive for depositors to run on weak banks. Our model highlights two countervailing effects. First, banks do less maturity transformation when depositors have access to CBDC, which leaves them less exposed to runs. Second, monitoring the flow of funds into CBDC allows policymakers to identify and resolve weak banks sooner, which also decreases depositors’ incentive to run. Our results suggest that a well-designed CBDC may decrease rather than increase financial fragility.

Keywords: CBDC, digital currency, financial stability, bank runs

JEL Classifications: E43, E58, G21