Trend Inflation Under Bounded Rationality

Published: December 5, 2023

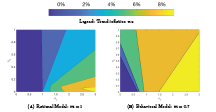

This paper evaluates the implications of introducing bounded rationality into a New Keynesian model with trend inflation. We develop a New Keynesian model with trend inflation that departs from rational expectations and introduces cognitive discounting. In a model with rational expectations, higher trend inflation generates macroeconomic instability by making the economy more susceptible to equilibrium indeterminacy. We find that cognitive discounting increases the region of determinacy, and therefore, trend inflation becomes less destabilizing (Working Paper no. 23-09).

Abstract

This paper evaluates the implications of introducing bounded rationality into a New Keynesian model with trend inflation. With rational expectations, trend inflation generates macroeconomic instability by making the economy more susceptible to equilibrium indeterminacy. We find that cognitive discounting increases the region of determinacy, and therefore, trend inflation becomes less destabilizing. We estimate the model using Bayesian methods allowing for both determinacy and indeterminacy. We find that the best-fitting model features bounded rationality and a determinate equilibrium.

Keywords: Determinacy and Indeterminacy, Bayesian Estimation, Inflation Targeting, Departures from Rational Expectations

JEL Classifications: E70, E52, E3, C22, E31