U.S. Money Market Funds Reach $6.4 Trillion at End of 2023

Published: March 26, 2024

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

U.S. money market funds (MMF) are an important source of short-term funding to the financial system because they invest large cash balances and hold mostly short-term investments. MMFs’ aggregate net assets reached a new record of $6.4 trillion on December 31, 2023, according to the OFR’s monthly U.S. Money Market Fund Monitor.

MMFs experienced cumulative inflows of $1.2 trillion in 2023, the largest on record. The flood of cash into MMFs was a product of higher yields on MMFs relative to alternative cash equivalent instruments as a result of the Federal Reserve’s continued interest rate increases.1 Investors’ concerns about the safety of deposits at regional banks also contributed to record MMF inflows early in the year, although their concerns seemed to have eased after regulators took action to stabilize the banking system.

MMF net inflows are expected to continue in the near term due to their comparatively higher yields and the central bank’s decision to maintain its policy rate. However, a shift in Federal Reserve policy actions or another market development could reverse the direction of MMF investor flows. A significant fluctuation in flows can exacerbate moves in asset prices and impede the normal function of short-term funding markets (see 2023 OFR Annual Report to Congress).

In the last quarter of 2023, the OFR MMF monitor showed that MMFs reduced their utilization of the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP) and increased their investment in U.S. Treasury securities and repo with banks and dealers. This change reflected two issues: (1) increased supply of alternative investments (e.g., higher yielding Treasury bills) offering slightly more attractive yields relative to the Federal Reserve’s ON RRP rate; and (2) less market uncertainty regarding path of policy rates. However, reduced ON RRP balances coupled with wider spreads from private counterparties may also represent lower market liquidity.

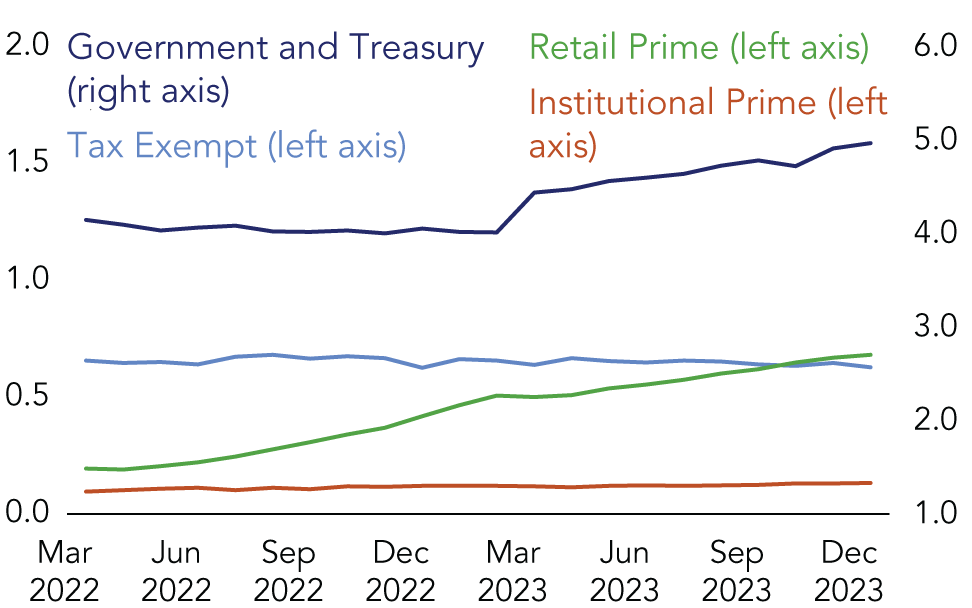

Retail Investors Account for Much of the Asset Growth

The MMF Monitor shows $1.2 trillion or 22% net increase in assets in 2023, with government funds attracting more than three-quarters of net new cash. Cumulative net asset flows were skewed during the year. Roughly 40% of net inflows occurred in March 2023, as concern about the safety of deposits following the collapse of a few regional banks prompted investors to reallocate $480 billion to MMFs—the second largest one-month increase on record. Institutional investors were responsible for 80% of the total March MMF inflows, reflective of their focus on liquidity and safety in periods of uncertainty and stress.

The pace of MMF asset growth, however, decelerated in subsequent months after regulators intervened and risk levels subsided. While institutional investors propelled MMF growth in March, retail investors accounted for more than 50% of the cumulative MMF net asset increase in 2023. Within the retail fund category, prime MMFs captured 45% (or $262 billion) of inflows. Meanwhile, most institutional cash inflows went to government MMFs and direct investments in the underlying short-term markets.

Figure 1. U.S. Money Market Fund Assets by Fund Types ($ trillions)

Note: Data as of Jan 17, 2024.

Sources: SEC Form N-MFP, Author’s analysis

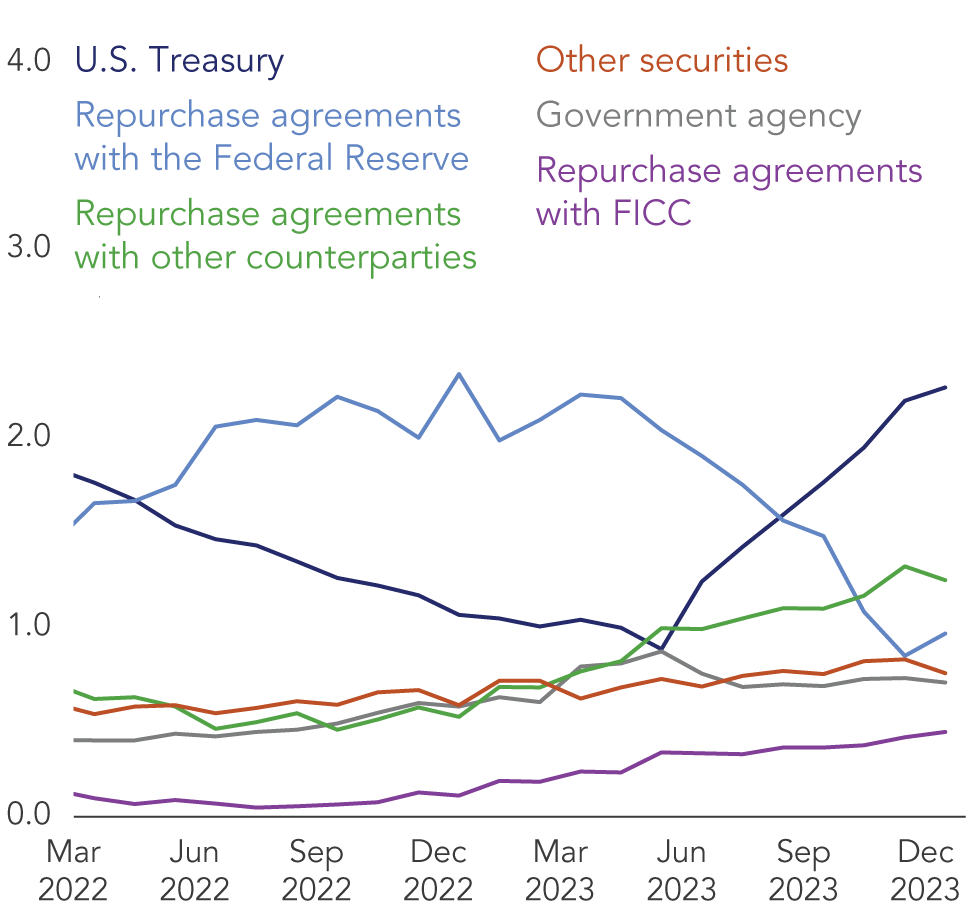

Figure 2. U.S. Money Market Fund Assets by Fund Types ($ trillions)

Note: Data as of Jan 17, 2024. Other securities includes those securities issued by corporations, financial companies, municipalities, and other fund money market structures.

Sources: SEC Form N-MFP, Author’s analysis

Declines in ON RRP Transactions Amid a Changing Investment Landscape

The OFR MMF Monitor shows that MMF investment allocation underwent significant shifts during 2023. The year commenced with the Federal Reserve continuing to tighten monetary policy. MMF advisors positioned portfolios to take advantage of potential future interest rate hikes by directing nearly 40% of their cash to the Federal Reserve’s ON RRP, with a one-day maturity that allowed the funds to quickly benefit from future policy interest rate increases while adding no incremental counterparty credit risk.

MMFs were also active investors in the debt issued by the Federal Home Loan Banks (FHLBs), boosting their holdings of FHLB debt securities from 9% to 12% of total fund assets in the first quarter of 2023. In response to stress in the banking system, the FHLBs, a system of cooperatively-owned, government-sponsored wholesale banks, provided funding to the banking system and boosted bank liquidity by redirecting proceeds from FHLB-recorded net debt public offerings to FHLB members.2 As signs of bank stress subsequently subsided, FHLBs liquidity support to banks and debt outstanding both decreased. As a result, MMF holdings of FHLB debt securities also declined.

As the year progressed, the supply of attractive alternative investments increased. Private counterparties in need of financing were willing to offer better rates. The supply of safe assets increased as the U.S. Department of the Treasury (Treasury) increased net bill and note issuance following the resolution on the debt ceiling in June. Finally, the level of market uncertainty around the path of future interest rates declined, prompting MMFs to modestly extend portfolio duration to lock in prevailing high rates.

MMFs eligible to participate in the ON RRP redirected some investment to Treasury bills, increasing total Treasury holdings by 113% to $2.3 trillion, as the Treasury increased the supply of Treasury bills and notes to fund its operating needs. MMFs were willing buyers of the new bill supply, in part, in an attempt to get ahead of a market-forecasted, lower-rate environment.

Additionally, MMFs increased their allocation to sponsored repo as the demand for financing from traditional counterparties willing to offer better rates on the transactions rose. MMFs increased their repo lending to financial institutions through the Fixed Income Clearing Corporation’s sponsored repo program to a total of $447 billion at year-end 2023, the highest level on record.3

While MMFs have been shifting away from the ON RRP and into U.S. Treasury securities and privately issued longer-term securities, the duration of portfolio holdings has also trended higher. In the aggregate, MMFs’ weighted average maturities were under 40 days, below the regulatory limit of 60 days but nearly double the year-end 2022 level. SEC MMF rules limit the weighted average maturity of a fund’s assets to minimize a fund’s exposure to significant market price fluctuation occurring during periods of volatile interest rate movements. The regulatory limit minimizes possible mark-to-market losses in the event a fund is forced to sell securities before their maturity to meet the liquidity needs of the fund’s shareholder base. This is important to financial stability because a fund with fewer liquid assets may be less equipped to honor significant redemption requests in markets where liquidity is tight without engaging in a fire sale of securities.

-

Historically yields on MMFs have moved in tandem with short-term policy rates while bank deposit rates have lagged. MMFs purchase relatively shorter-duration assets against their shares which enables them to frequently reset their yields at higher levels in response to the Federal Reserve’s interest rate increases. Banks tend to hold longer duration assets against their deposit balances, providing less latitude to reset deposit yields without adversely impacting profitability. The current tightening cycle is no different, although the size and pace of the Federal Reserve’s policy rate increases since March 2022 led to a significant spread between MMF yields and bank deposit rates. ↩

-

Chartered by Congress to support mortgage lending, the Federal Home Loan Bank System (FHLB System or System) has evolved into important providers of funding for banks, most notably through advances secured by mortgage collateral. In March 2023, the FHLB system issued $247 billion in net debt at the height of the banking sector funding stress. This was the highest month-over-month increase in FHLB debt outstanding in the System’s history. FHLB debt outstanding reached more than $1.5 trillion at the end of May 2023, far surpassing the previous record of $1.3 trillion at the end of October 2008. FHLBs issued short-term debt, largely purchased by MMFs, to fund lending activities. At the end of March 2023, 75% of FHLB debt outstanding matured within one year while 62% of FHLB advances repaid in less than one year. MMFs held 46% of FHLB overall debt obligations and 58% of FHLB short-term debt at month-end March 2023. ↩

-

The Fixed Income Clearing Corporation’s (FICC) sponsored repurchase agreement services (repo) enables its clearing members to sponsor their institutional clients in the cleared bilateral repo market, where FICC serves as the central counterparty to the lender and borrower, allowing FICC clearing members to net these cleared repo transactions off balance sheet, thus freeing up balance sheet capacity or capital. ↩